50/30/20 Budget Template Excel Free

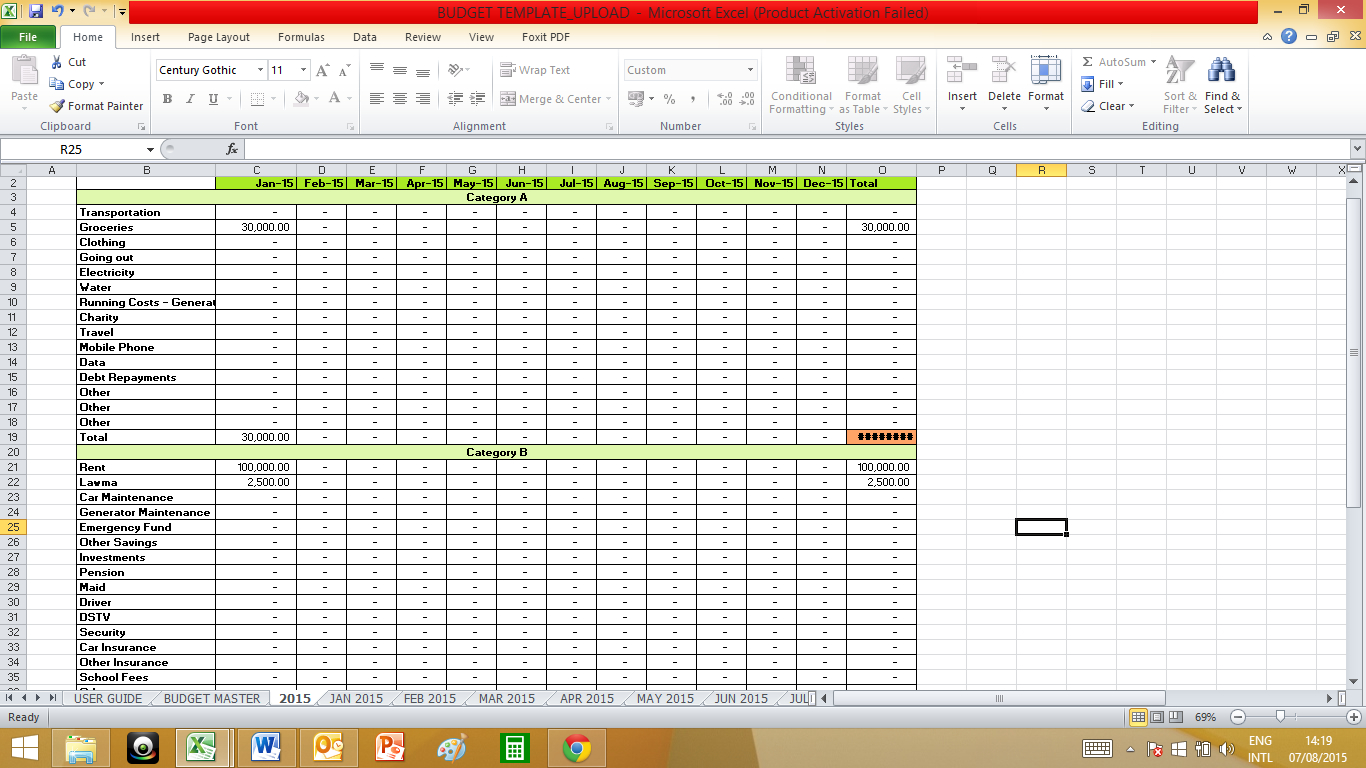

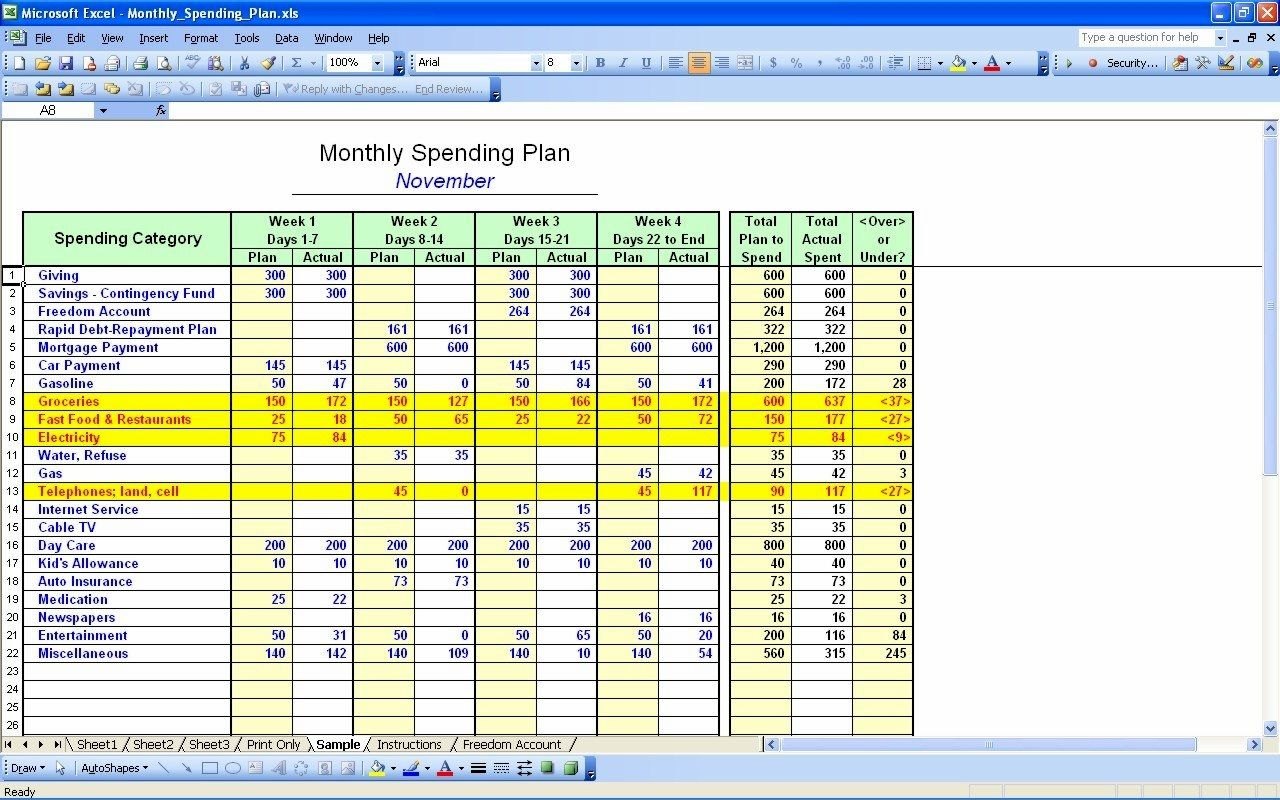

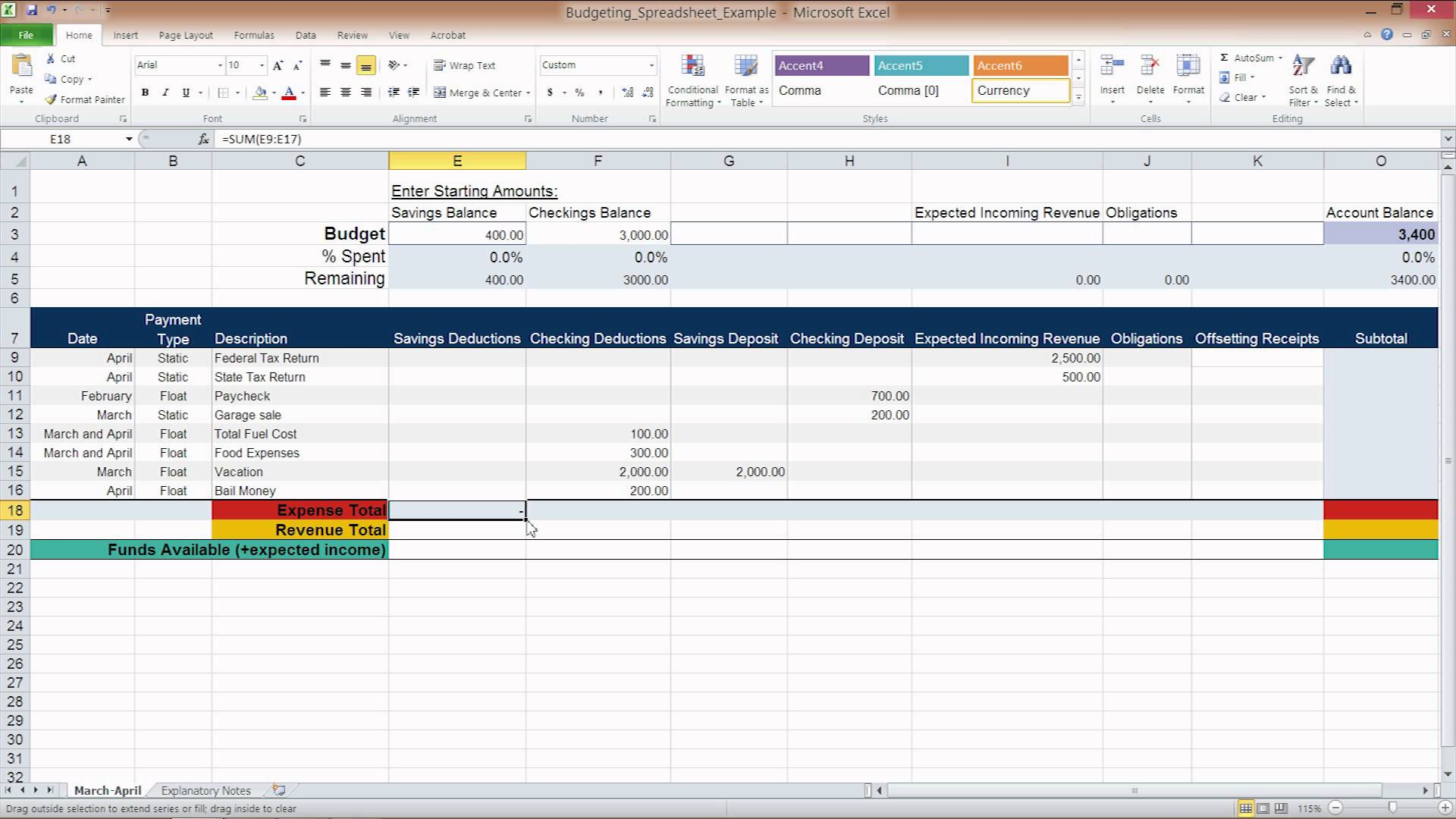

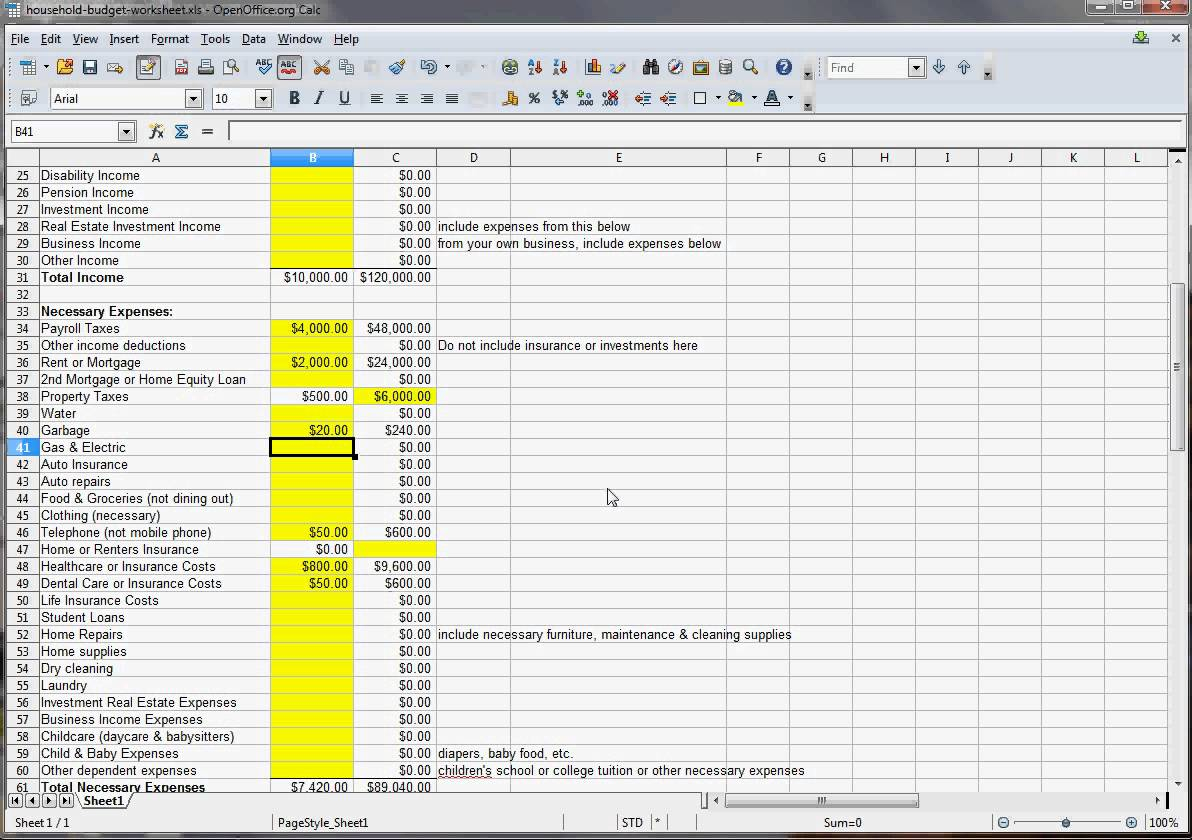

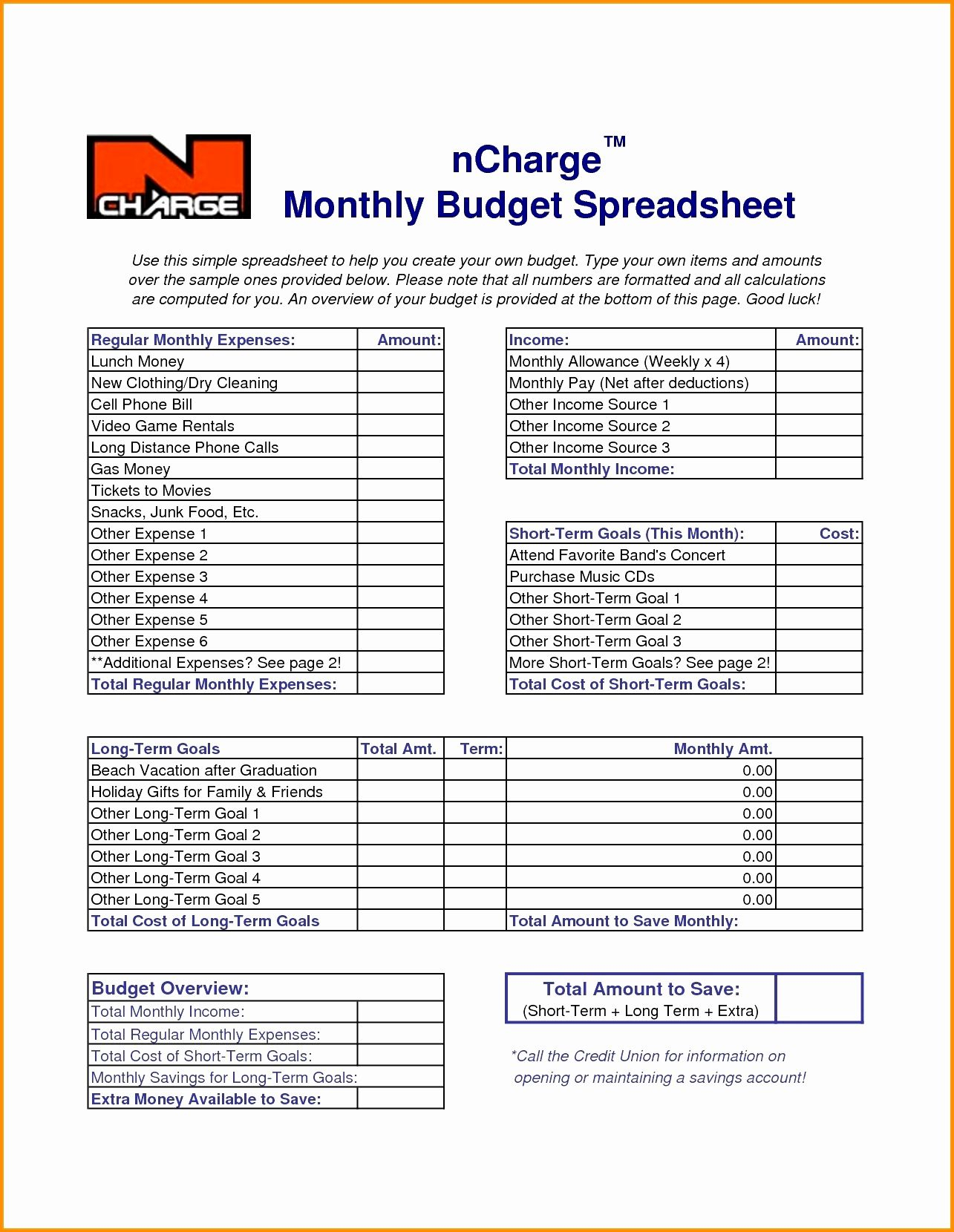

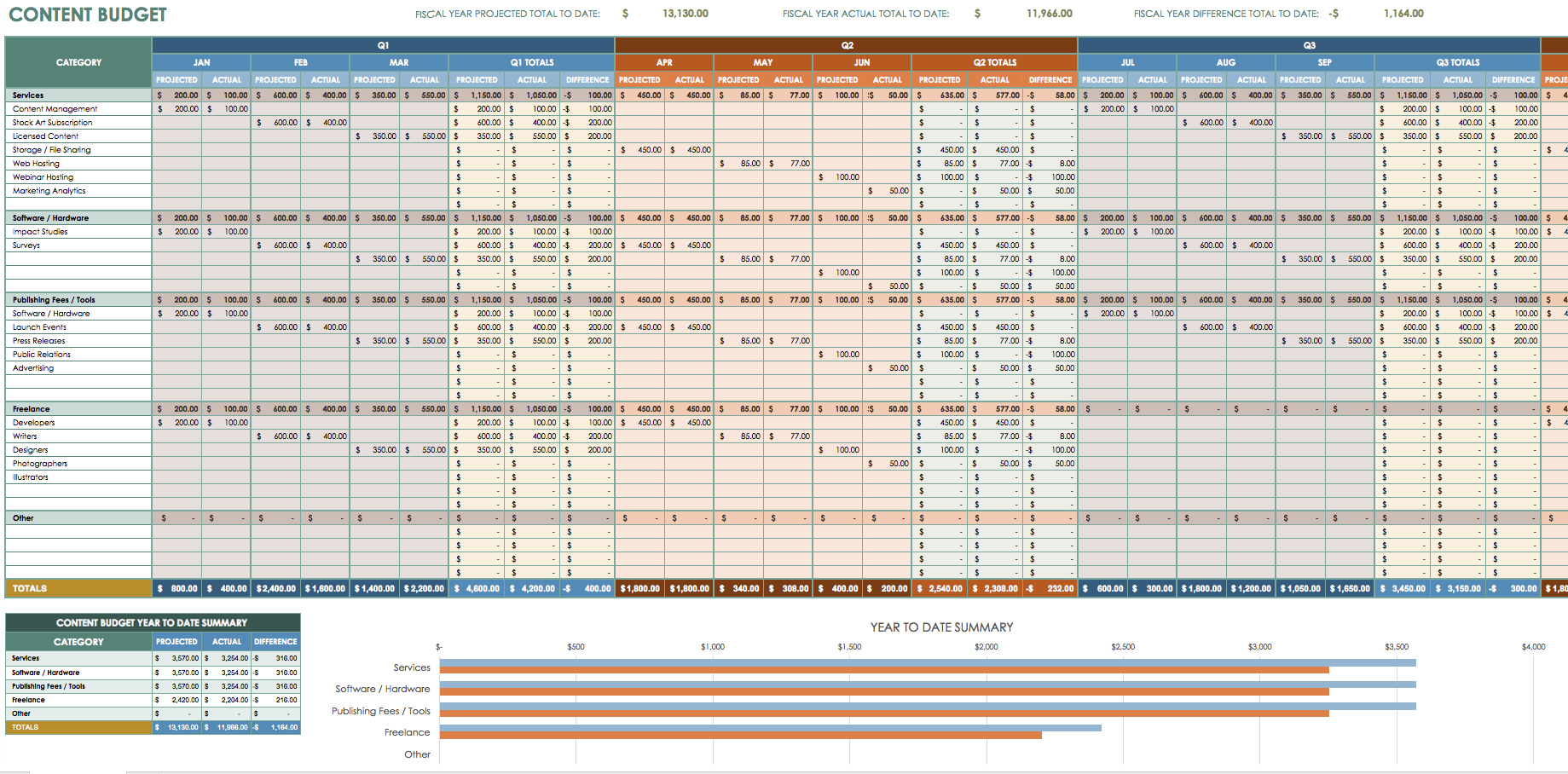

50/30/20 Budget Template Excel Free - Insert chart to visualize easily free template: In the real world, you need to prioritize wants and needs. After looking on the internet, i created a very simple excel document to help me manage my finance. What is the 50 30 20 budget rule? Best free yearly budget spreadsheet Achieve financial balance and security with template.net's 50 30 20 budget template. So you might decide to save a more but also carry debt a bit longer. $720 (401k and hsa) total income: Web we offer a free 50/30/20 calculator and spreadsheet to calculate your savings according to this rule. Many experts agree that one simple way to budget is to divide your income into three parts: 50% of income going to needs, 30% going to wants, and the remaining 20% going to savings and financial goals. Web this excel template can help you track your monthly budget by income and expenses. Web the 50/30/20 budget won’t work for everyone. Determine surplus or shortage step 06: Input your costs and income, and any difference is calculated automatically. Web best yearly budget template: This free monthly budget template divides your monthly budget into needs/wants/savings to ensure that you are within the guidelines. > get this personal budget template Web we offer a free 50/30/20 calculator and spreadsheet to calculate your savings according to this rule. Best free yearly budget spreadsheet Insert chart to visualize easily free template: It also compares your monthly budget to your actual spending. In the real world, you need to prioritize wants and needs. Compare projected costs with actual costs to hone your budgeting skills over time. 50% of income going to needs, 30% going to wants, and the remaining 20% going to savings and financial. Or you might decide it’s worth it to spend more than 50% on living expenses. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and. 50% for your needs, 30% for your wants and 20% for your savings. What is. If this budget sheet isn’t right for you, try another tool. Here’s a breakdown of how it works: Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Web best yearly budget template: In the real world, you need to prioritize wants and needs. Compare actual expenses with the ideal budget step 05: Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. Your needs, your wants, and your. Best free yearly budget spreadsheet The template was made for excel but will work in google sheets or numbers for mac users. Best free yearly budget spreadsheet Compute expenses in 3 different categories step 04: Web it sounds harder than it is. Compare projected costs with actual costs to hone your budgeting skills over time. The ultimate lifetime money plan. Compute expenses in 3 different categories step 04: By heather phillips june 8, 2023 if you’re unsure of how to budget your expected income, a popular and effective approach is a 50/30/20 budget. Your needs, your wants, and your. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any. Or you might decide it’s worth it to spend more than 50% on living expenses. So you might decide to save a more but also carry debt a bit longer. The ultimate lifetime money plan. Web 50/30/20 budget calculator to plan your income and expenses. Web best yearly budget template: Or you might decide it’s worth it to spend more than 50% on living expenses. Achieve financial balance and security with template.net's 50 30 20 budget template. It’s a simple rule to give a general guideline on how to budget your money. Compute expenses in 3 different categories step 04: Here’s a breakdown of how it works: It also compares your monthly budget to your actual spending. If you think it will work for you, you can even download our printable majority monthly budget worksheet for free. Calculate monthly income step 02: It’s a simple rule to give a general guideline on how to budget your money. Or you might decide it’s worth it to spend more than 50% on living expenses. The ultimate lifetime money plan. Follow along for a quick budget example. Web download our free excel budgeting template for the 50 30 20 method. Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. By heather phillips june 8, 2023 if you’re unsure of how to budget your expected income, a popular and effective approach is a 50/30/20 budget. 50% for your needs, 30% for your wants and 20% for your savings. > get this personal budget template For those using a program other than. Determine surplus or shortage step 06: Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses. Compare actual expenses with the ideal budget step 05: Compare projected costs with actual costs to hone your budgeting skills over time. Many experts agree that one simple way to budget is to divide your income into three parts: Web extend your foundation template with a free 50/30/20 budget calculator. Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide. Compare actual expenses with the ideal budget step 05: What is the 50 30 20 budget rule? The 50 / 30 / 20 rule was first coined by elizabeth warren and her daughter in her book all your worth: Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and. Budget & money management sample 50/30/20 worksheet home file insert page layout formulas data review view edit view insert format data tools Or you might decide it’s worth it to spend more than 50% on living expenses. 50% for your needs, 30% for your wants and 20% for your savings. Ready to use conclusion related articles download. Here’s a breakdown of how it works: Compute expenses in 3 different categories step 04: Web we offer a free 50/30/20 calculator and spreadsheet to calculate your savings according to this rule. Follow along for a quick budget example. Compare projected costs with actual costs to hone your budgeting skills over time. So you might decide to save a more but also carry debt a bit longer. > get this personal budget template Hopefully, the snapshot provides a view of what’s possible.50 30 20 Budget Excel Spreadsheet —

50 30 20 Budget Templates Spreadsheets

50/30/20 Excel Budget Template Etsy

50 30 20 Budget Excel Spreadsheet Google Spreadshee 50 30 20 budget

50 30 20 Budget Excel Spreadsheet —

50 30 20 Budget Spreadsheet Template throughout 50 30 20 Budget

Free Printable 50 30 20 Budget Spreadsheet Template Printable Templates

50 30 20 Budget Excel Spreadsheet Google Spreadshee 50 30 20 budget

50 30 20 Budget Excel Spreadsheet for The 503020 Budget

50 30 20 Budget Excel Spreadsheet Spreadsheets

Your Needs, Your Wants, And Your.

Web Use The Free Budget Worksheet Below To See How Your Spending Compares With The 50/30/20 Budget Guide.

In The Real World, You Need To Prioritize Wants And Needs.

This Free Monthly Budget Template Divides Your Monthly Budget Into Needs/Wants/Savings To Ensure That You Are Within The Guidelines.

Related Post: