Asc 606 Revenue Recognition Memo Template

Asc 606 Revenue Recognition Memo Template - Further, fasb asc 606 requires two types of disclosures: This is a critical time for organizations to assess their disclosure accounting practices related to the asc 606 revenue recognition standard. Web in contrast, fasb asc 606 introduces a comprehensive disclosure package designed to improve users’ understanding about the nature, amount, timing, and uncertainty of revenue recognized. Web adoption of new accounting standards: How to allocate the transaction price of each performance obligation Step 3 → determine the specific transaction price (and other pricing terms) stated in the contract. Our roadmap can help you manage this process. If no, revenue cannot be recognized until there are no remaining obligations and consideration is received and is nonrefundable, the contract has. Web revenue recognition methods under asc 606 should cover criteria, timing, and other core aspects of contract revenue recognition. Each question and answer includes the. Web asc 606 established the following five steps that must be applied in order to implement the revenue recognition guidance: Description of performance obligation form of contract arrangement for the performance obligation Identify the contract(s) with a customer. This is a perfect sandbox! Pwc's latest q&a guide helps these companies navigate common issues. Web asc 606 revenue recognition examples and what you can learn from them this article explains the accounting treatment of implementing the revenue recognition steps, including allocating transaction prices and recording journal entries. Web asc 606 revenue recognition examples: The q&a document includes 81 questions organized by subject matter. Web assess your disclosure accounting practices. If no, revenue cannot be. Web if yes, move to step 3; Web asc 606 revenue recognition examples and what you can learn from them this article explains the accounting treatment of implementing the revenue recognition steps, including allocating transaction prices and recording journal entries. Get access to a tool already being used for big 4 audits to help companies with asc 606 implementation. A. Web adoption of new accounting standards: This is a critical time for organizations to assess their disclosure accounting practices related to the asc 606 revenue recognition standard. Identify the performance obligations in the contract. Step 3 → determine the specific transaction price (and other pricing terms) stated in the contract. Get access to a tool already being used for big. Step 2 → identify the distinct performance obligations within the contract. Web asc 606 established the following five steps that must be applied in order to implement the revenue recognition guidance: Web principles for recognizing revenue. Web adoption of new accounting standards: Web business tools can include excel spreadsheets, financial models, templates, checklists, dashboards and whitepapers. Deferral of the effective date. Identify the contract(s) with a customer. It is important to understand that a contract could be within the scope of both the new revenue standard and the guidance on collaborative. Transition disclosures, which are required only in the year of adoption, and recurring, annual. Revenue recognition podcasts insights from pwc revenue recognition: Gauge the material impact on your financials; Web download our excel spreadsheet template for implementing asc 606 revenue recognition. Step 3 → determine the specific transaction price (and other pricing terms) stated in the contract. This is a perfect sandbox! Each question and answer includes the. An entity shall recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for. Gauge the material impact on your financials; Web in contrast, fasb asc 606 introduces a comprehensive disclosure package designed to improve users’ understanding about the nature,. Evaluate revenue streams relative to new standards; The policy should be documented, reviewed and approved by appropriate levels of management and include the following for each performance obligation: Web adoption of new accounting standards: Web business tools can include excel spreadsheets, financial models, templates, checklists, dashboards and whitepapers. Step 1 → identify the signed contract between the seller and customer. Web business tools can include excel spreadsheets, financial models, templates, checklists, dashboards and whitepapers. The q&a document includes 81 questions organized by subject matter. It is important to understand that a contract could be within the scope of both the new revenue standard and the guidance on collaborative. Web asc 606 instructs the entity to recognize revenue for the transfer. Web revenue recognition methods under asc 606 should cover criteria, timing, and other core aspects of contract revenue recognition. How to allocate the transaction price of each performance obligation Step 3 → determine the specific transaction price (and other pricing terms) stated in the contract. Evaluate revenue streams relative to new standards; Web asc 606 revenue recognition examples: Step 2 → identify the distinct performance obligations within the contract. Description of performance obligation form of contract arrangement for the performance obligation It is important to understand that a contract could be within the scope of both the new revenue standard and the guidance on collaborative. Web in august 2015, the board issued accounting standards update no. Web each entity should consider developing a revenue recognition policy under asc 606. The q&a document includes 81 questions organized by subject matter. If no, revenue cannot be recognized until there are no remaining obligations and consideration is received and is nonrefundable, the contract has. Gauge the material impact on your financials; Get access to a tool already being used for big 4 audits to help companies with asc 606 implementation. Web asc 606 instructs the entity to recognize revenue for the transfer of goods or services in an amount that reflects the consideration which the entity expects it is entitled to receive from customers in exchange for those goods or services. Customers are defined as a party that has contracted with an entity to obtain goods or services in the. Deferral of the effective date. Web according to the revenue recognition principle of asc 606, the only way to identify and estimate such income is to match the amount that a company expects to get from the products or services a company provided. Pwc's latest q&a guide helps these companies navigate common issues. Web in contrast, fasb asc 606 introduces a comprehensive disclosure package designed to improve users’ understanding about the nature, amount, timing, and uncertainty of revenue recognized. Web asc 606 revenue recognition template understand rev rec and strategize for the future best practices tested in numerous big 4 audits; If no, revenue cannot be recognized until there are no remaining obligations and consideration is received and is nonrefundable, the contract has. Gauge the material impact on your financials; Identify the contract(s) with a customer. Pwc's latest q&a guide helps these companies navigate common issues. A q&a guide for software and saas entities there are unique considerations when accounting for software and saas arrangements. It is important to understand that a contract could be within the scope of both the new revenue standard and the guidance on collaborative. Web where should i start? Further, fasb asc 606 requires two types of disclosures: This is a critical time for organizations to assess their disclosure accounting practices related to the asc 606 revenue recognition standard. Step 2 → identify the distinct performance obligations within the contract. Web in contrast, fasb asc 606 introduces a comprehensive disclosure package designed to improve users’ understanding about the nature, amount, timing, and uncertainty of revenue recognized. Deferral of the effective date. Revenue recognition podcasts insights from pwc revenue recognition: Step 1 → identify the signed contract between the seller and customer. Transition disclosures, which are required only in the year of adoption, and recurring, annual.Asc 606 Excel Template Master of Documents

ASC 606 Revenue Recognition (5Step Model)

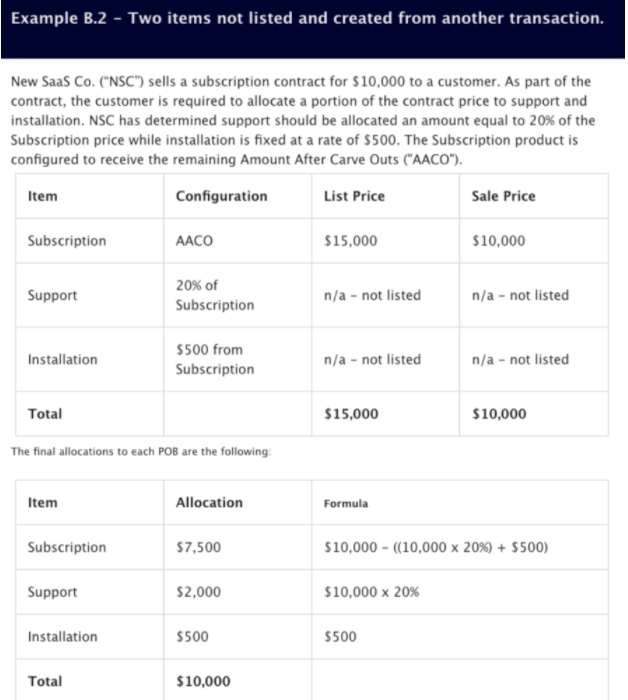

Step 4 Allocation of Transaction Price RevGurus

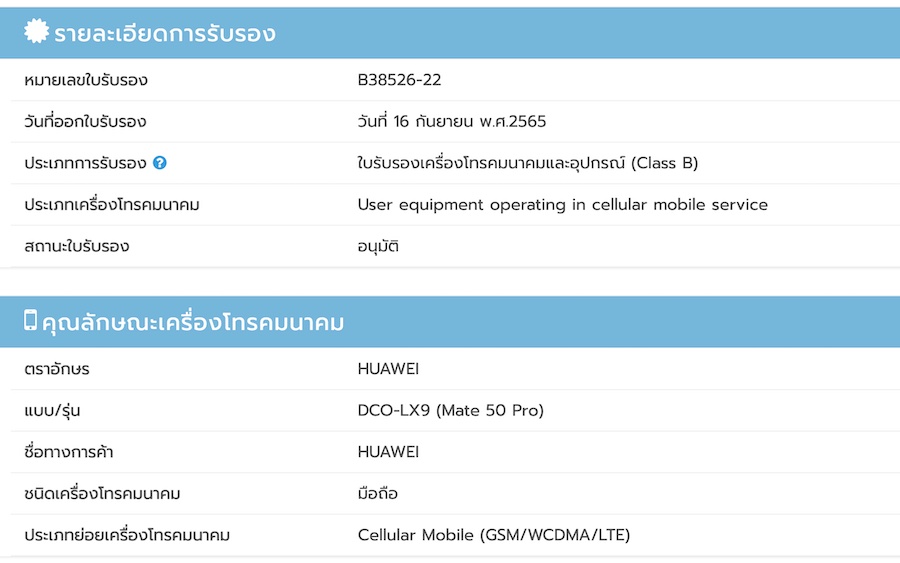

ผู้ใช้ HUAWEI Mate 50 Pro ชาวมาเลเซีย แชร์วิดีโอที่สาธิตการใช้แอปจาก

The complete guide to SaaS revenue recognition with ASC 606 ChartMogul

(PDF) Revenue Recognition Considerations for Producers and Natural Gas

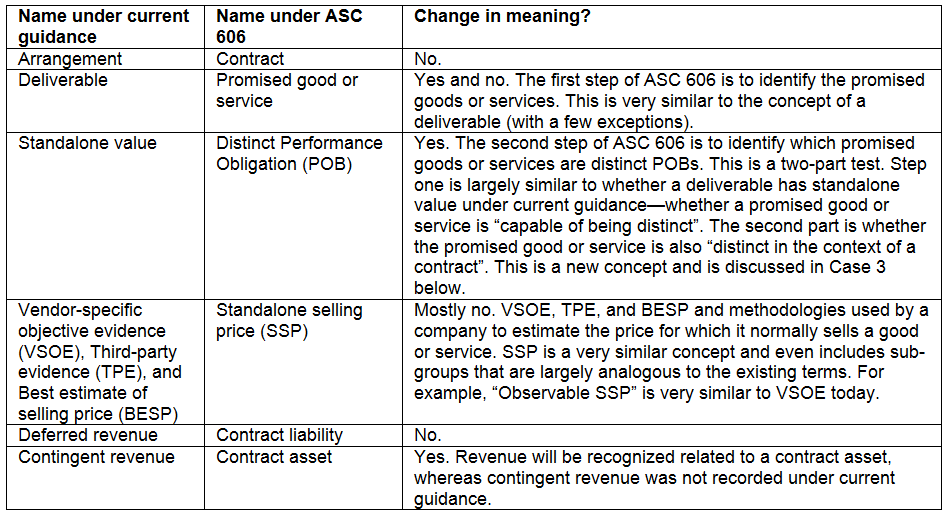

ASC 606/IFRS 15 A Financial Professional's Guide to Revenue…

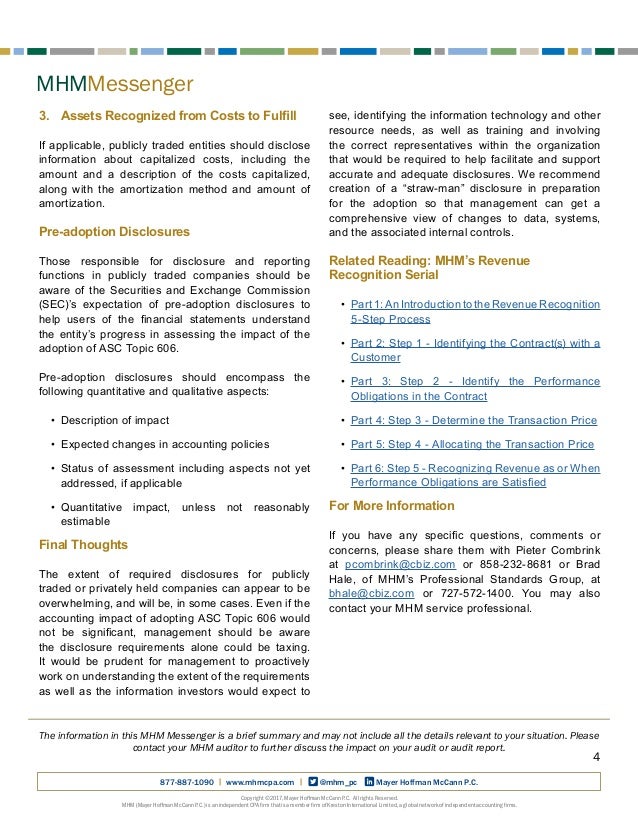

Full Disclosure A Guide to Revenue Recognition Disclosures under ASC…

Sample Technical Accounting Memo Classles Democracy

SaaS Revenue Recognition & ASC606 SaaSOptics

Web Assess Your Disclosure Accounting Practices.

Web Download Our Excel Spreadsheet Template For Implementing Asc 606 Revenue Recognition.

To Determine If You’re On Track, Examine Revenue Recognition Disclosure Examples From Other Companies, See How You Stack Up, And Then Determine If.

The Q&A Document Includes 81 Questions Organized By Subject Matter.

Related Post: