Asc 842 Lease Amortization Schedule Template

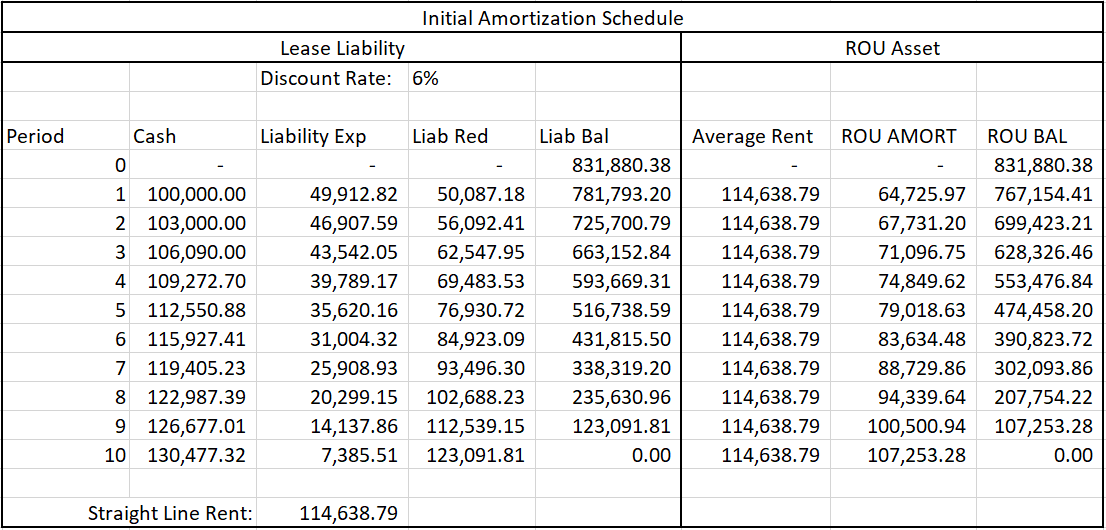

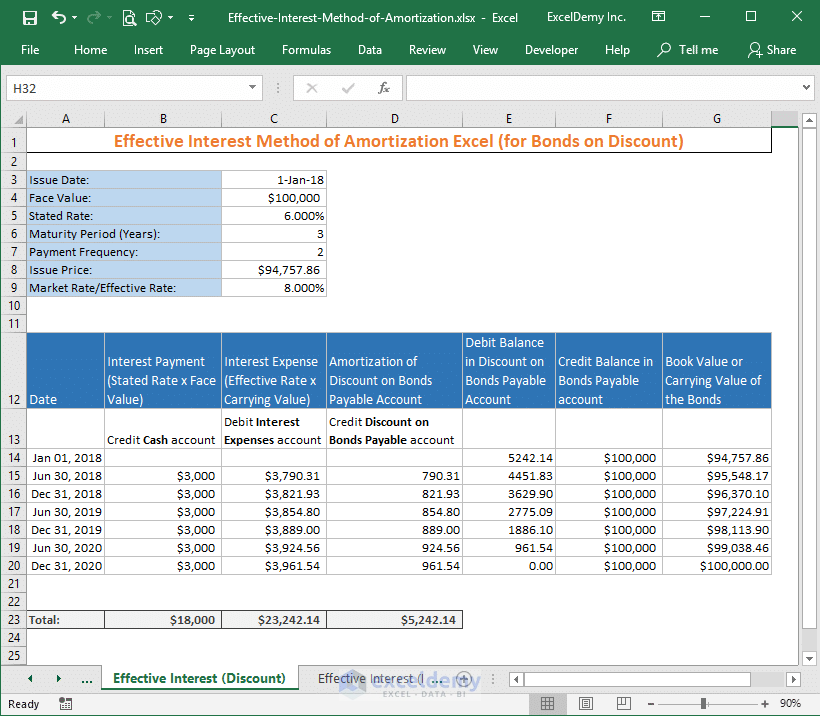

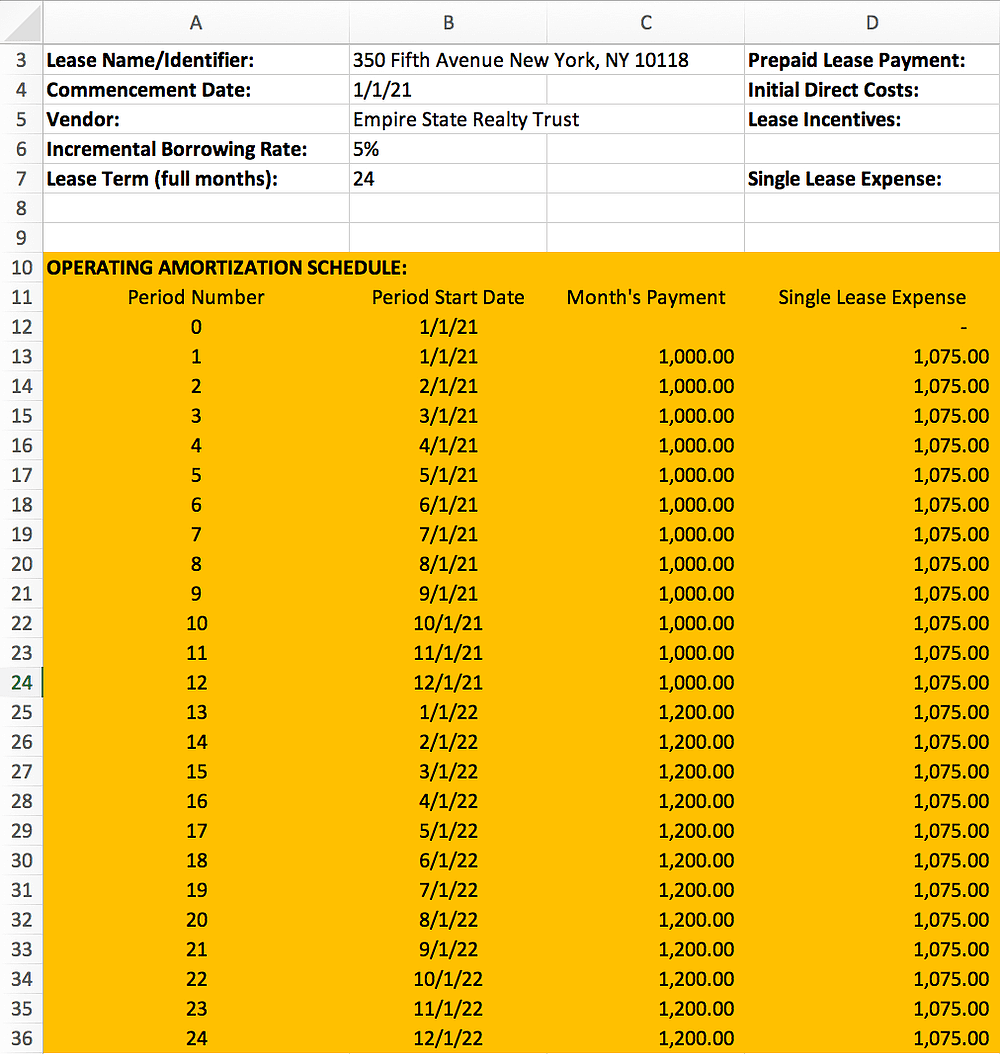

Asc 842 Lease Amortization Schedule Template - The first four chapters provide an introduction and guidance on determining whether an arrangement is (or contains) a lease and how to classify and account for lease and nonlease components. Web 1 day agocomparing asc 842, gasb 87, and ifrs 16. Automatic lease accounting and compliance to asc 842, astm 16 and aasb 16 with or without netsuite; Web deferred rent journal entries under asc 842 for year 1. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Operating lease treatment under asc 842 vs. The entry the lessee makes at the beginning of the lease agreement under asc 842 is to record the initial rou asset and lease liability. Asc 842 lease classification template. That classification is determined by a number of factors of the lease and that classification could change if the terms of the lease change over time. Subsequent entries follow the amounts set forth in the amortization table. The entry for the annual activity of 2023 is below. That classification is determined by a number of factors of the lease and that classification could change if the terms of the lease change over time. Lease liability $116,357.12 right of use asset $116,357.12 Web it's essentially like accounting for all your leases as if they were capital leases under. Web under asc 842, regardless of the classification of the lease, operating, or finance, a company must recognize a right of use asset for the majority of leases. Web with this lease amortization schedule you will be able to : Lease liability $116,357.12 right of use asset $116,357.12 Automatic lease accounting and compliance to asc 842, astm 16 and aasb. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or contains) a lease and how to classify and account for lease and nonlease components. Although asc 842 removed leveraged lease accounting, leases that met the definition of. Web 1 day agocomparing asc 842, gasb 87, and ifrs 16. Finance lease accounting under asc 842. Given the lease is for a stipulated period, the right of use asset must go to zero when the lessee no longer has control over the leased asset. Under asc 842, operating leases and financial leases have different amortization calculations. Web 1 day agocomparing asc 842, gasb 87, and ifrs 16. Under asc 842, an operating lease you now recognize:. Although asc 842 removed leveraged lease accounting, leases that met the definition of. Capital lease criteria under asc 840 3. Web with this lease amortization schedule you will be able to : The entry the lessee makes at the beginning of the lease agreement under asc 842 is to record the initial rou asset and lease liability. The entry to. What is a capital/finance lease? Reminders and examples about how to determine the lessee’s incremental borrowing rate. Web with this lease amortization schedule you will be able to : Web the amortization for a finance lease under asc 842 is very straightforward. Web it's essentially like accounting for all your leases as if they were capital leases under asc 840. Under ifrs 16, lessees account for all leases like finance leases in asc 842. Calculate your monthly lease liabilities and rou assets in compliance with asc 842. Web it's essentially like accounting for all your leases as if they were capital leases under asc 840. Templates for operating and financing leases under asc 842. A roadmap to adoption and implementation. A roadmap to adoption and implementation lease accounting is like a tale of two cities, with companies that have adopted asc 842 in one and those that have not yet adopted the standard in the other. What is a capital/finance lease? Finance lease accounting under asc 842 and examples The entry for the annual activity of 2023 is below. Web. Web provides guidance about how a lessee determines the discount rate for a lease under asc 842. Calculate your monthly lease liabilities and rou assets in compliance with asc 842. The entry the lessee makes at the beginning of the lease agreement under asc 842 is to record the initial rou asset and lease liability. Web it's essentially like accounting. Web deferred rent journal entries under asc 842 for year 1. Although asc 842 removed leveraged lease accounting, leases that met the definition of. Web this guide discusses lessee and lessor accounting under asc 842. Under asc 842, an operating lease you now recognize: Use for a few, simple leases. Under asc 842, operating leases and financial leases have different amortization calculations. Web the amortization schedule for this lease is below. Finance lease identification under asc 842 transference of title/ownership to the lessee purchase option lease term for major part of the remaining economic life of the asset present value represents “substantially all” of the fair value of. That classification is determined by a number of factors of the lease and that classification could change if the terms of the lease change over time. Web asc 842 lease amortization schedule. Automatic lease accounting and compliance to asc 842, astm 16 and aasb 16 with or without netsuite; Web how to calculate your lease amortization. Under asc 842, an operating lease you now recognize: What is a capital/finance lease? The entry for the annual activity of 2023 is below. This is a big difference from asc 840! Operating lease under asc 842 how to record a finance lease and journal entries 5. Lease liability $116,357.12 right of use asset $116,357.12 Web 1 day agocomparing asc 842, gasb 87, and ifrs 16. Although asc 842 removed leveraged lease accounting, leases that met the definition of. With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. The present value of all known future lease payments. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability: While all three standards require lessees to recognize most leases on their balance sheets, there are notable differences among them: Finance lease accounting under asc 842 and examples Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Lease liability $116,357.12 right of use asset $116,357.12 Finance lease accounting under asc 842 and examples Templates for operating and financing leases under asc 842. Web this guide discusses lessee and lessor accounting under asc 842. Use for a few, simple leases. Under ifrs 16, lessees account for all leases like finance leases in asc 842. Given the lease is for a stipulated period, the right of use asset must go to zero when the lessee no longer has control over the leased asset. Web automate lease accounting in any erp for asc 842, ifrs 16 and gasb 87; The entry the lessee makes at the beginning of the lease agreement under asc 842 is to record the initial rou asset and lease liability. Under asc 842, an operating lease you now recognize: Web 1 day agocomparing asc 842, gasb 87, and ifrs 16. Using the facts presented in this example, the amortization table below is for the entire term of the lease: Operating lease under asc 842 how to record a finance lease and journal entries 5. Calculate your monthly lease liabilities and rou assets in compliance with asc 842. Web the amortization for a finance lease under asc 842 is very straightforward.How to Calculate the Lease Liability and RightofUse (ROU) Asset for

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Excel Template Download

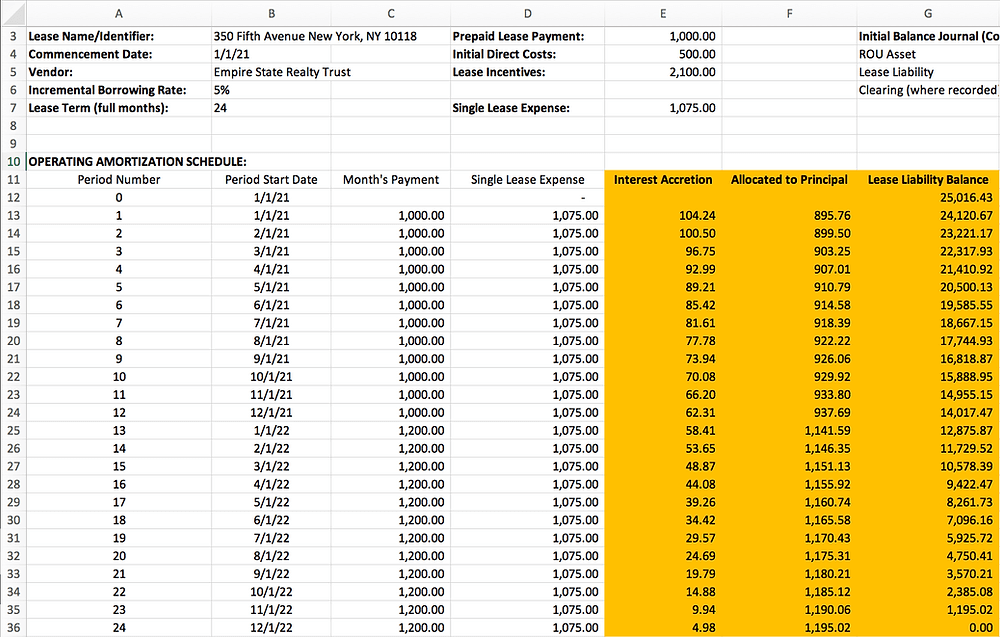

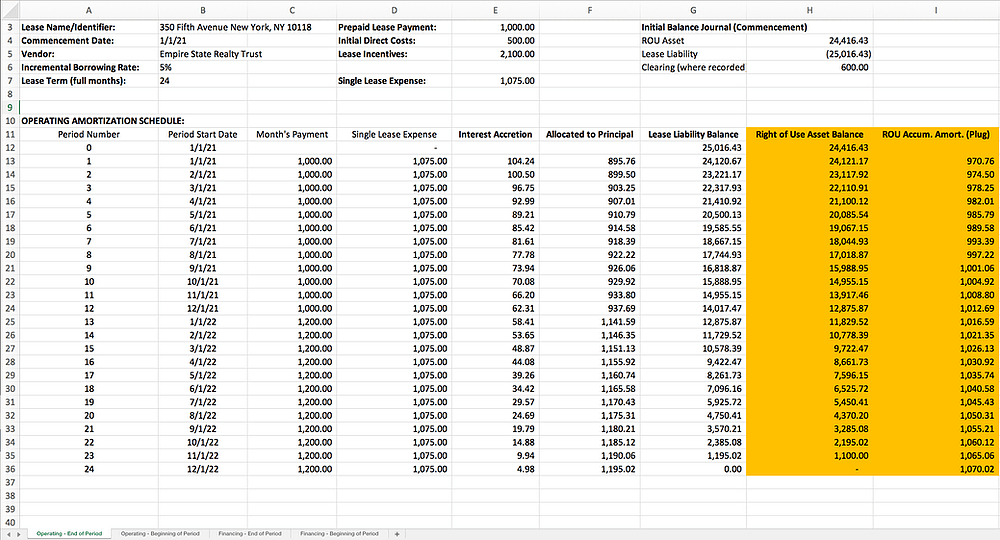

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Asc 842 Excel Template Free Portal Tutorials

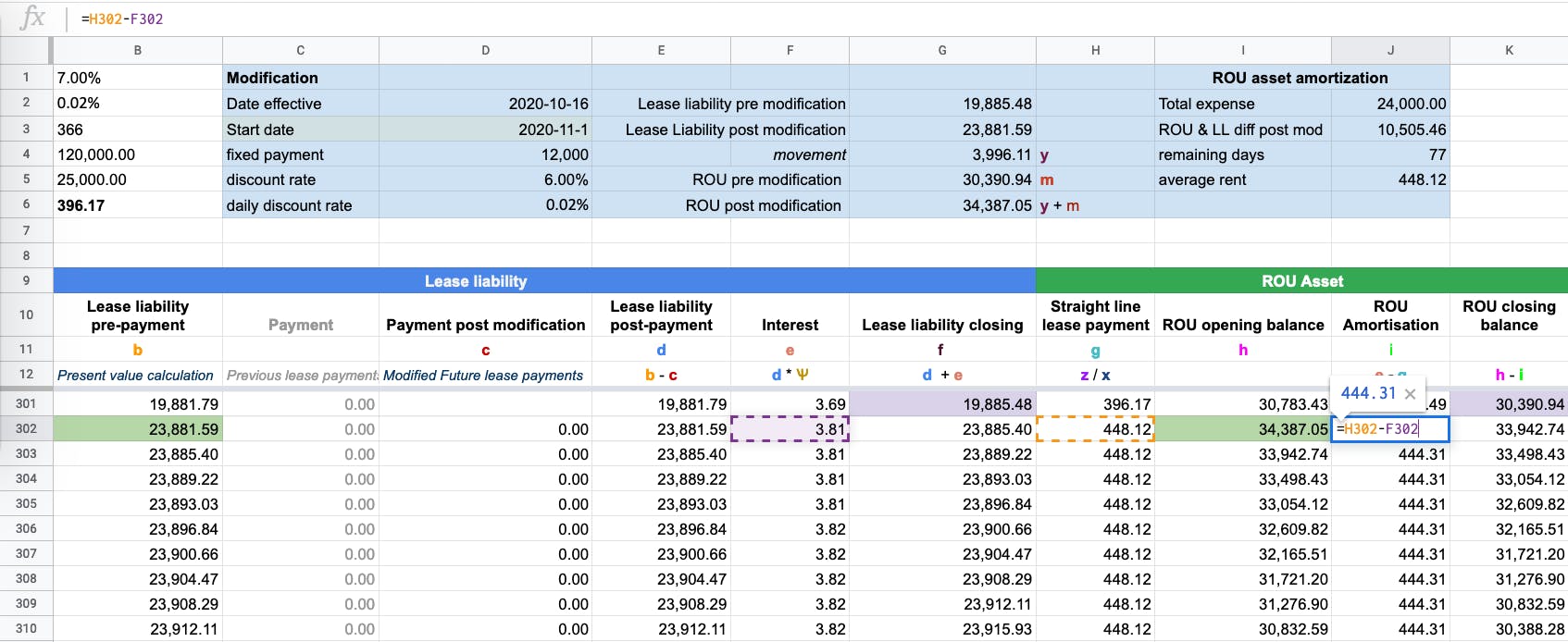

Lease Modification Accounting for ASC 842 Operating to Operating

Asc 842 Excel Template

Free Lease Amortization Schedule Excel Template

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Reminders And Examples About How To Determine The Lessee’s Incremental Borrowing Rate.

Web Provides Guidance About How A Lessee Determines The Discount Rate For A Lease Under Asc 842.

Subsequent Entries Follow The Amounts Set Forth In The Amortization Table.

Capital Lease Criteria Under Asc 840 3.

Related Post: