Dcf Model Excel Template

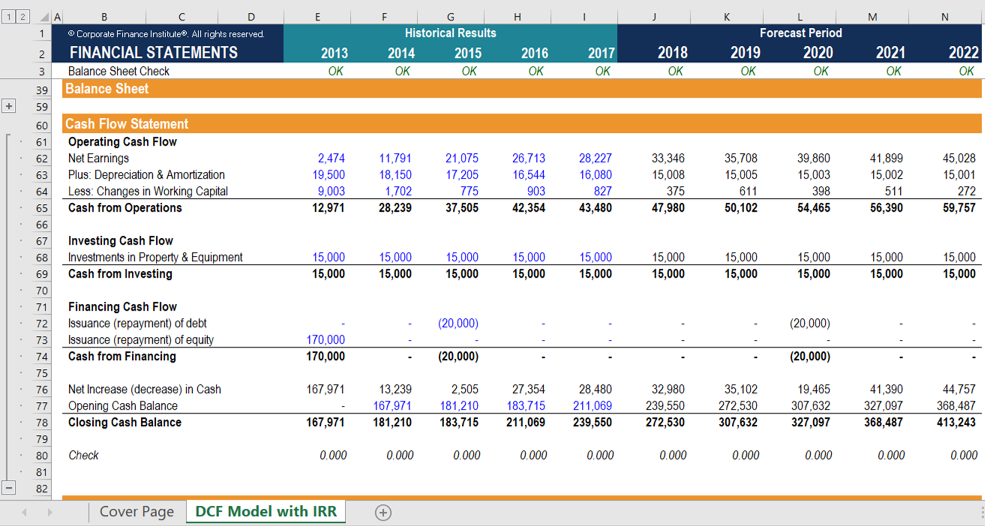

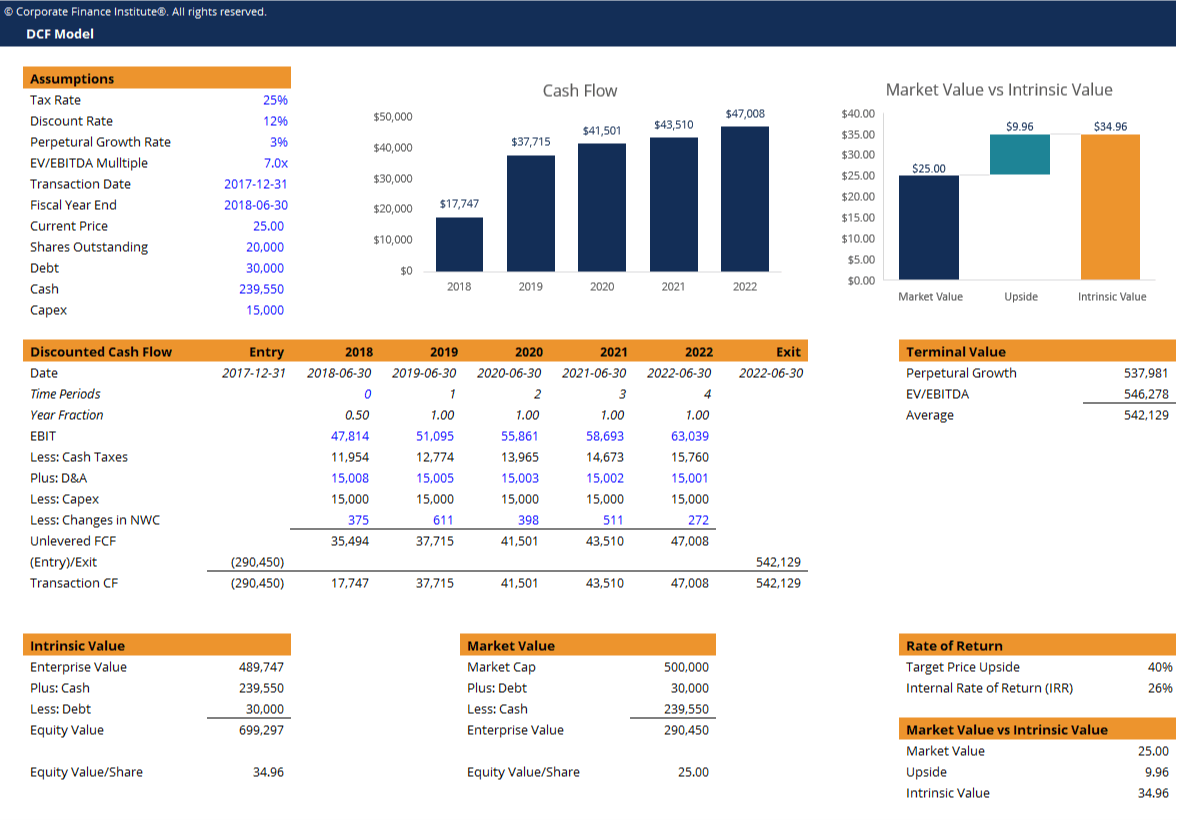

Dcf Model Excel Template - Web financial modeling excel templates. What is time value of money. This template allows you to build your own discounted cash. Dcf stands for d iscounted c ash f. This solid and simple dcf model excel template is formulated in a way that allows users to analyze. Formula to calculate free cash flow. Web download now the dcf valuation model free excel template. Web 1 minutes read. The discounted free cash flow (dcf) method is a widely. Financial model templates which contain a dcf model. This model provides a rough guide. The discounted free cash flow (dcf) method is a widely. What is free cash flow? Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web dcf model templates | efinancialmodels. Web 1 minutes read. Web financial modeling excel templates. This template allows you to build your own discounted cash. Web january 31, 2022. Dcf stands for d iscounted c ash f. Dcf stands for d iscounted c ash f. Download them and feel free to modify them to your own specifications. How can dcf valuations help investors?. Web download now the dcf valuation model free excel template. Download wso's free discounted cash flow (dcf) model template below! Web dcf model templates | efinancialmodels. Web 1 minutes read. Input the valuation date, discount rate, perpetual growth rate, and tax rate. In this section, we will calculate the free cashflow to equity (fcfe). What is time value of money. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. What is free cash flow? In this section, we will calculate the free cashflow to equity (fcfe). This solid and simple dcf model excel template is formulated in a way that allows users to analyze. Web dcf model templates. Download wso's free discounted cash flow (dcf) model template below! Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial. The discounted free cash flow (dcf) method is a widely. How can dcf valuations help investors?. In this section, we will calculate the free cashflow to equity (fcfe). What is a dcf model? Dcf analysis is a valuation method which uses future cash flow predictions to estimate investment return potential by discounting these projections to a. This solid and simple dcf model excel template is formulated in a way that allows users to analyze. Forecast the company's key financials and calculate the corresponding. The macabacus discounted cash flow. Web updated may 7, 2023. Calculate free cashflow to equity (fcfe) using discounted cash flow formula in excel. Download wso's free discounted cash flow (dcf) model template below! Web dcf model templates | efinancialmodels. This template allows you to build your own discounted cash. Input the valuation date, discount rate, perpetual growth rate, and tax rate. What is time value of money. This model provides a rough guide. A dcf model is a specific type of financial modeling tool used to value a business. Formula to calculate free cash flow. Download wso's free discounted cash flow (dcf) model template below! What is time value of money. Dcf analysis is a valuation method which uses future cash flow predictions to estimate investment return potential by discounting these projections to a. This solid and simple dcf model excel template is formulated in a way that allows users to analyze. Learn financial modeling. This template allows you to build your own discounted cash. A dcf model is a specific type of financial modeling tool used to value a business. What is a dcf model? Download them and feel free to modify them to your own specifications. Web 1 minutes read. Web dcf model templates | efinancialmodels. Web download now the dcf valuation model free excel template. Web financial modeling excel templates. Dcf analysis is a valuation method which uses future cash flow predictions to estimate investment return potential by discounting these projections to a. Financial model templates which contain a dcf model. Formula to calculate free cash flow. What is time value of money. What is free cash flow? This model provides a rough guide. Download wso's free discounted cash flow (dcf) model template below! Calculate free cashflow to equity (fcfe) using discounted cash flow formula in excel. Web january 31, 2022. Forecast the company's key financials and calculate the corresponding. Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial. Web these spreadsheet programs are in excel and are not copy protected. Formula to calculate free cash flow. What is time value of money. Download them and feel free to modify them to your own specifications. Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial. Forecast the company's key financials and calculate the corresponding. What is a dcf model? How can dcf valuations help investors?. A dcf model is a specific type of financial modeling tool used to value a business. This solid and simple dcf model excel template is formulated in a way that allows users to analyze. Dcf analysis is a valuation method which uses future cash flow predictions to estimate investment return potential by discounting these projections to a. Web download now the dcf valuation model free excel template. Web dcf model templates | efinancialmodels. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Download wso's free discounted cash flow (dcf) model template below! What is free cash flow? Web updated may 7, 2023.10 Best Dcf Model Template In Excel By Ex Deloitte Consultants Images

10 Best Dcf Model Template In Excel By Ex Deloitte Consultants Images

DCF model tutorial with free Excel

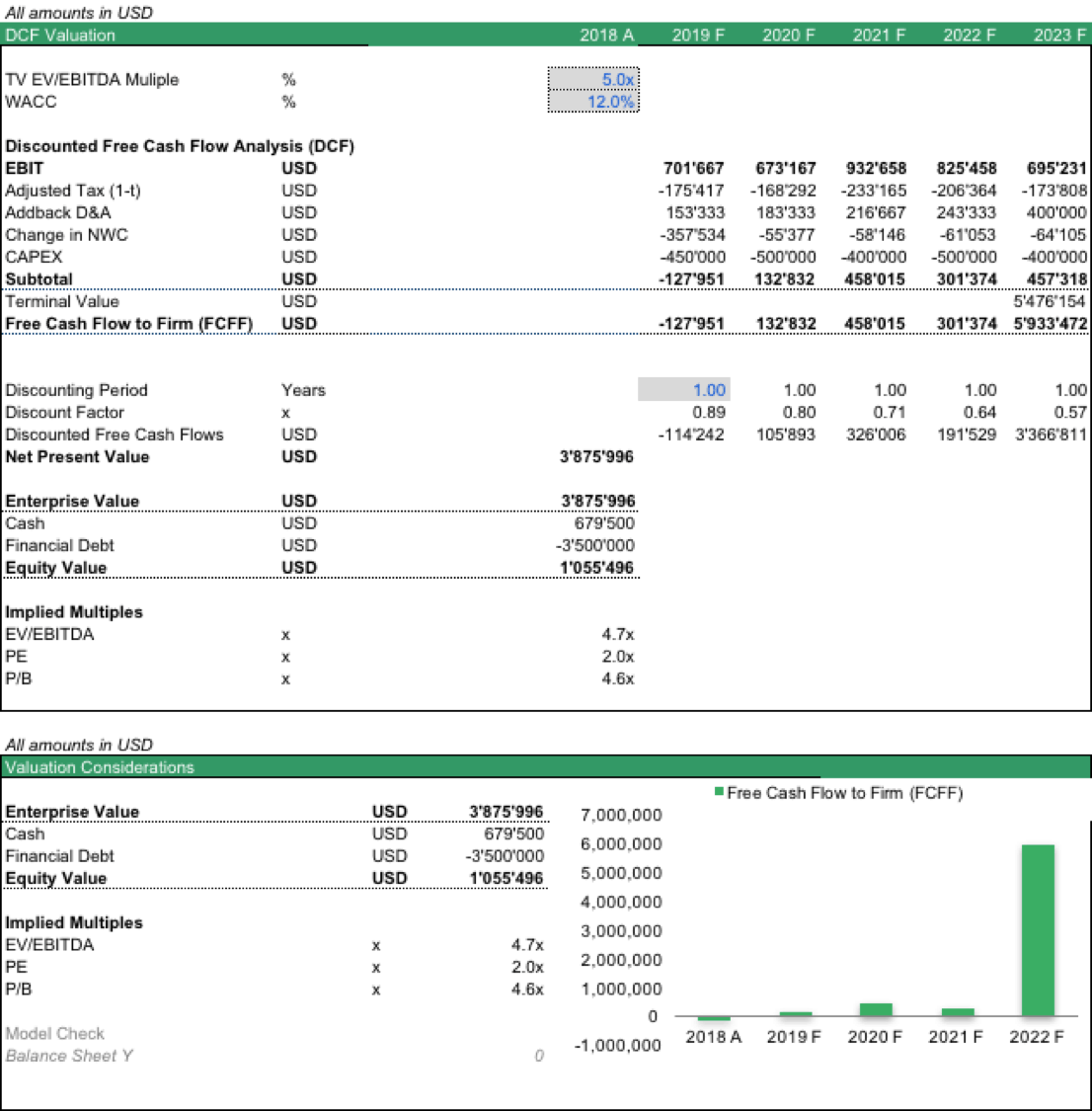

Dcf Valuation Excel Template Portal Tutorials

Single Sheet DCF (Discounted Cash Flow) Excel Template FinWiser

Dcf Valuation Excel Template Portal Tutorials

DCF model Discounted Cash Flow Valuation eFinancialModels

DCF Model Template Download Free Excel Template

DCF, Discounted Cash Flow Valuation in Excel Video YouTube

Single Sheet DCF (Discounted Cash Flow) Excel Template FinWiser

In This Section, We Will Calculate The Free Cashflow To Equity (Fcfe).

It Includes An Example To Help You Apply The.

Input The Valuation Date, Discount Rate, Perpetual Growth Rate, And Tax Rate.

Dcf Stands For D Iscounted C Ash F.

Related Post: