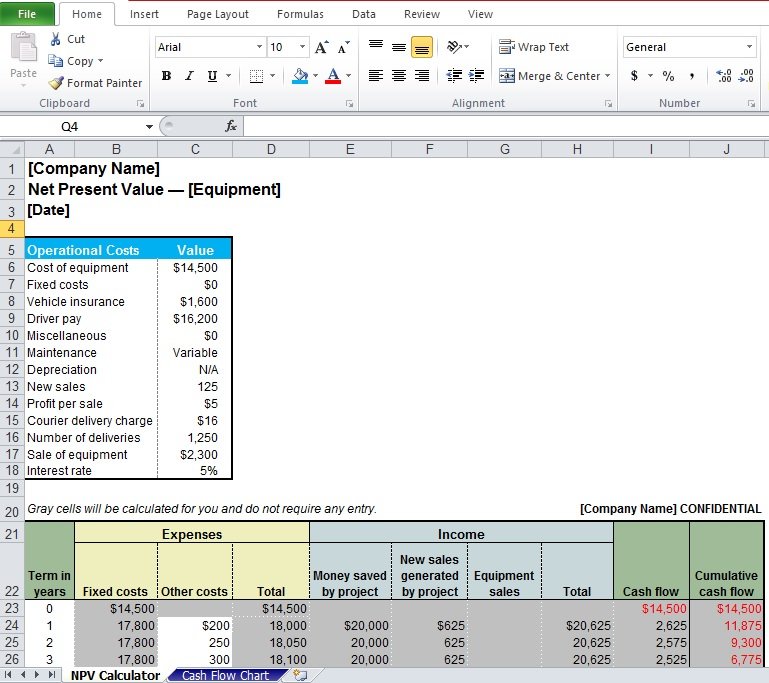

Net Present Value Excel Template

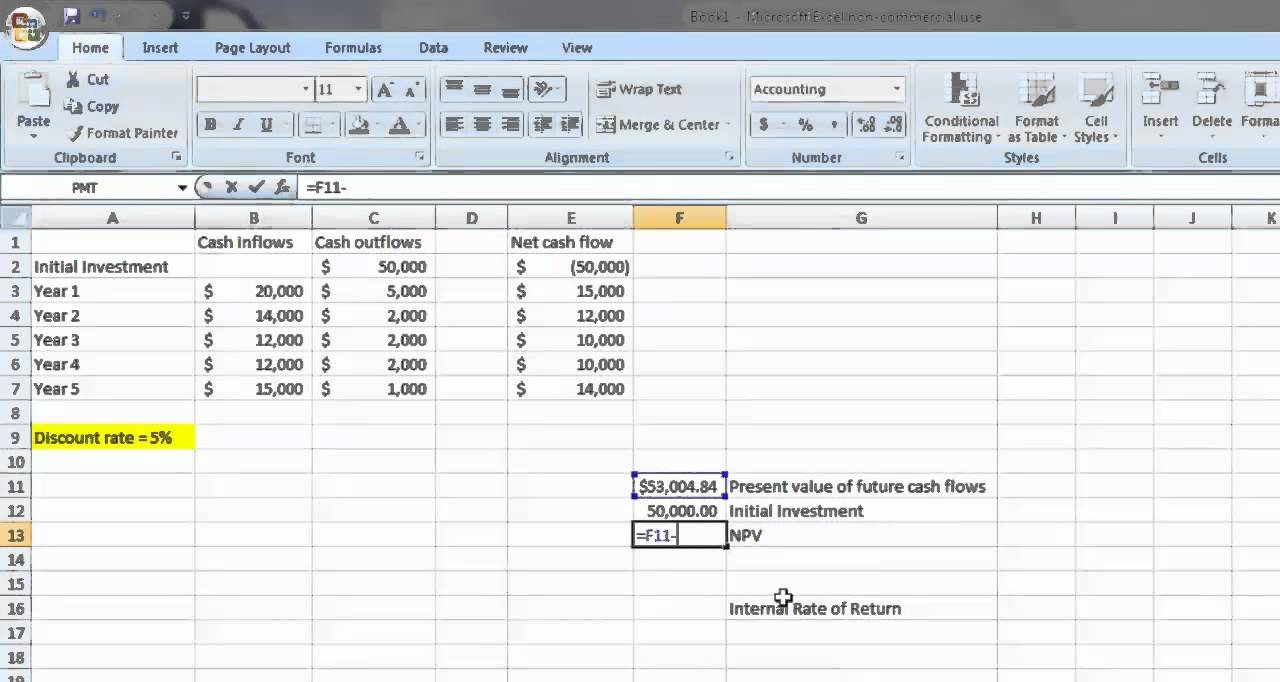

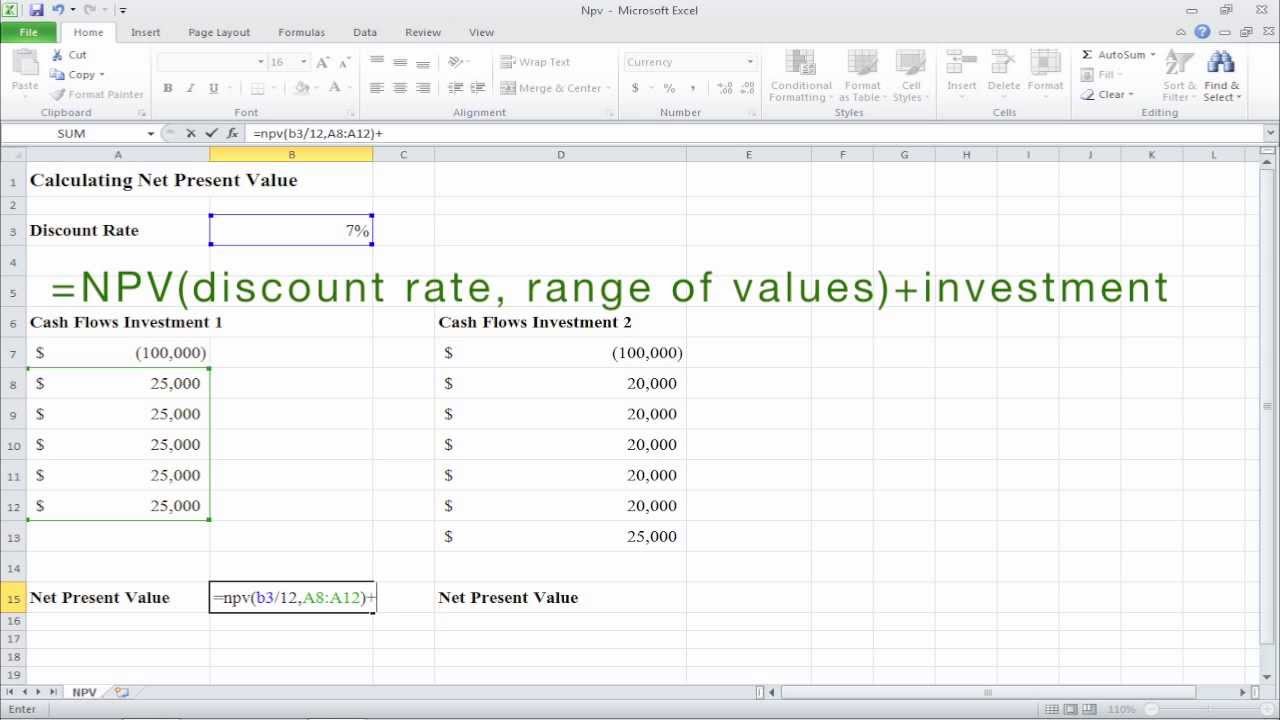

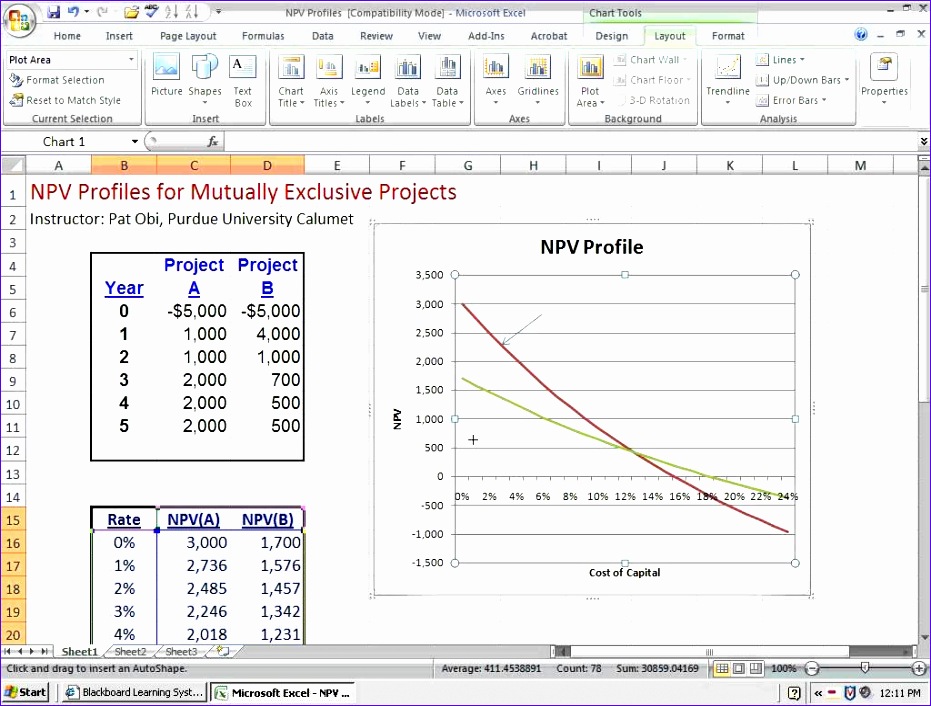

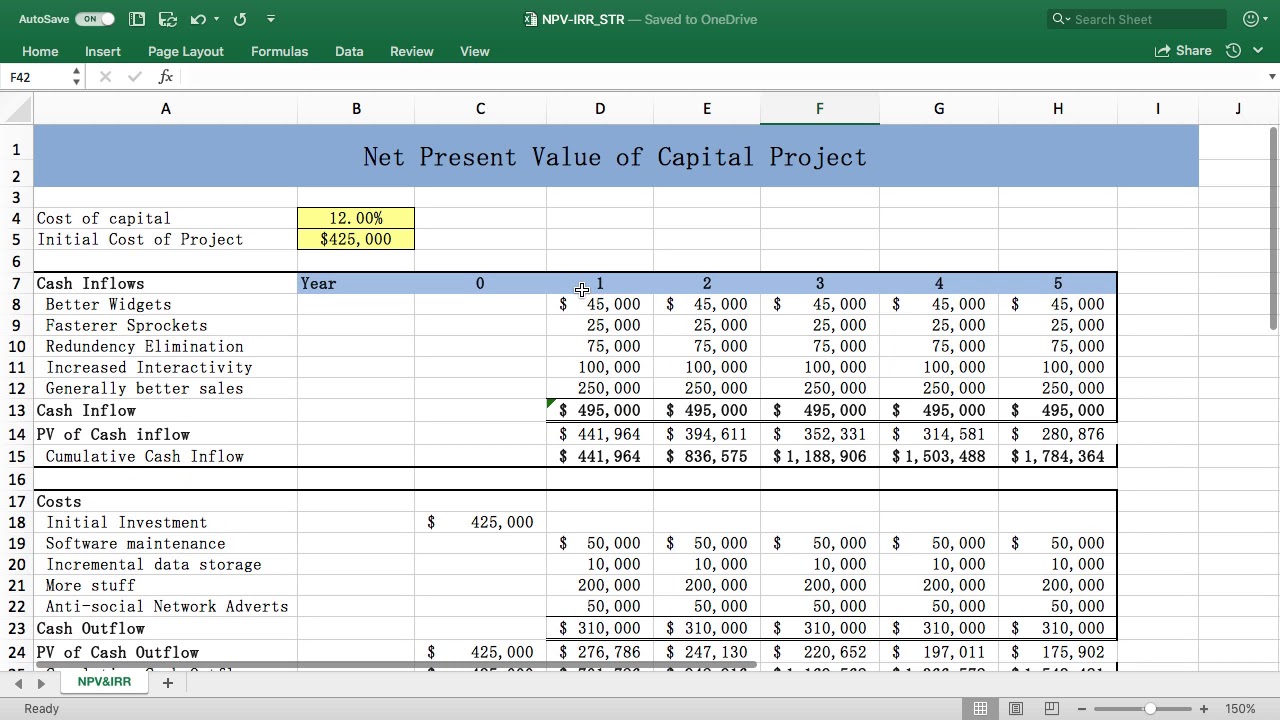

Net Present Value Excel Template - Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. Adjusted present value (apv) is used for the valuation of projects and companies. Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. Use the excel formula coach to find the. Web the npv function is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Web enter your name and email in the form below and download the free template now! Web what is net present value (npv)? Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. It is commonly used to evaluate whether a project or stock is. For example, project a requires. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. To calculate the net present. Web the npv function is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. The discount rate. Web what is net present value (npv)? Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. Use the excel formula coach to find the. This is not rocket science. Web enter your name and email in the form below and download the free template now! Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. Web how do you calculate net present value in excel? April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a. Z1 = cash flow in time 1 z2 = cash. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. The discount rate is the rate for one period, assumed to be. Use the excel formula coach to find the. Web how do you calculate net present value in excel? Web how to use the npv formula in. Web the npv function is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. Use the excel formula coach to find the. Web npv formula the. Web enter your name and email in the form below and download the free template now! Web the npv function is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. It is commonly used to evaluate whether a project or stock is. To calculate the net. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. Web the npv function is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. Web npv calculates the net present value (npv) of an investment using a. To calculate the net present. Z1 = cash flow in time 1 z2 = cash flow in time 2 r = discount rate x0 = cash outflow in time 0 (i.e. Web how do you calculate net present value in excel? The discount rate is the rate for one period, assumed to be. Web net present value excel template updated: It is commonly used to evaluate whether a project or stock is. Z1 = cash flow in time 1 z2 = cash flow in time 2 r = discount rate x0 = cash outflow in time 0 (i.e. To calculate the net present. Where n is the number of. Web you can use pv with either periodic, constant payments (such. Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability. Web the npv function is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. The discount rate is the rate for one period, assumed to be. Web how do you calculate net present value in excel? Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a. For example, project a requires. Where n is the number of. Z1 = cash flow in time 1 z2 = cash flow in time 2 r = discount rate x0 = cash outflow in time 0 (i.e. The formula for npv is: This is not rocket science. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web how to use the npv formula in excel. Adjusted present value (apv) is used for the valuation of projects and companies. Web what is net present value (npv)? Web enter your name and email in the form below and download the free template now! Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal. To calculate the net present. Adjusted present value (apv) is used for the valuation of projects and companies. The formula for npv is: Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. Where n is the number of. April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. It is commonly used to evaluate whether a project or stock is. Use the excel formula coach to find the. Web the net present value represents the discounted values of future cash inflows and outflows related to a specific investment or project. Web the npv function is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. Web npv formula the formula for net present value is: Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web how to use the npv formula in excel. Web net present value excel template updated: The discount rate is the rate for one period, assumed to be.Net Present Value Excel Template

8 Npv Calculator Excel Template Excel Templates

Net Present Value Calculator Excel Template SampleTemplatess

How to Calculate Net Present Value (Npv) in Excel YouTube

Best Net Present Value Formula Excel transparant Formulas

Net Present Value Excel Template

Professional Net Present Value Calculator Excel Template Excel TMP

Net Present Value Calculator Excel Templates

10 Excel Net Present Value Template Excel Templates

10 Excel Net Present Value Template Excel Templates

Web Present Value (Pv)—Also Known As A Discount Value—Measures The Value Of Future Cash Flows In Today’s Dollar.

This Is Not Rocket Science.

For Example, Project A Requires.

Web Enter Your Name And Email In The Form Below And Download The Free Template Now!

Related Post: