Payback Period Excel Template

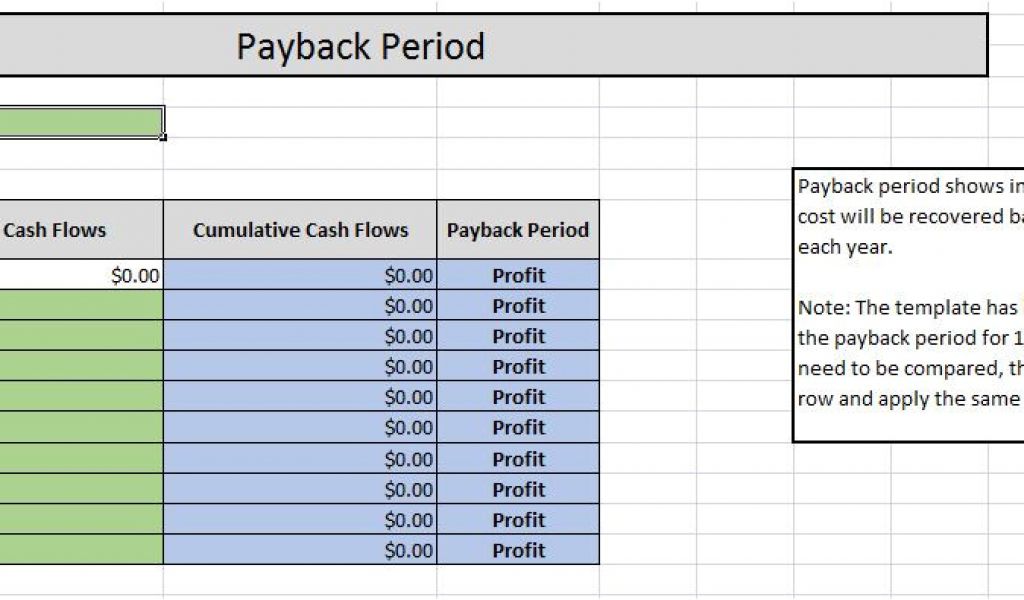

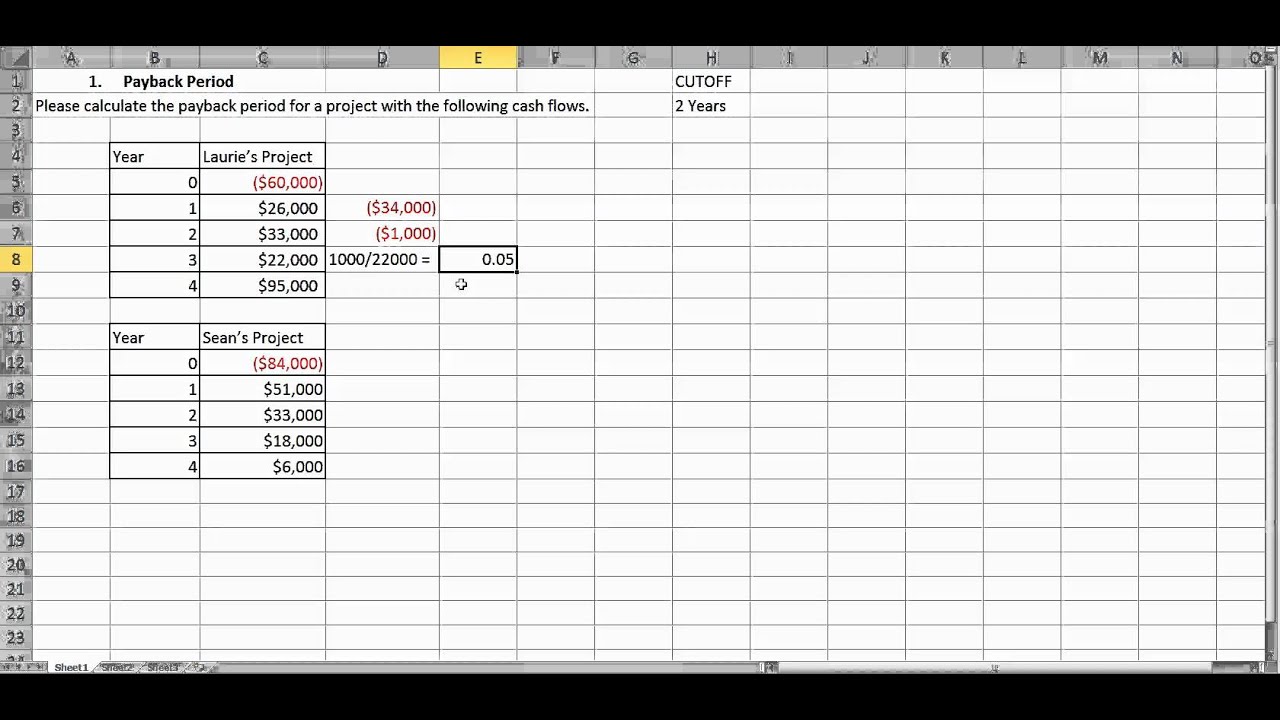

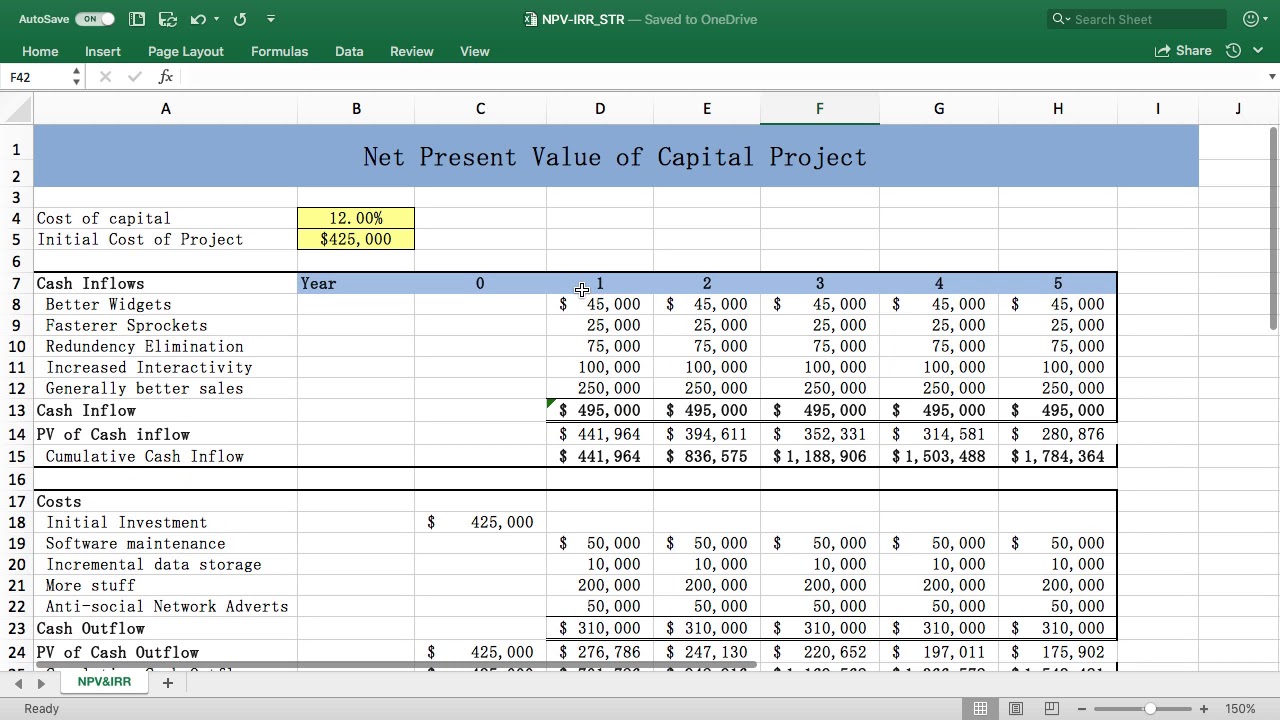

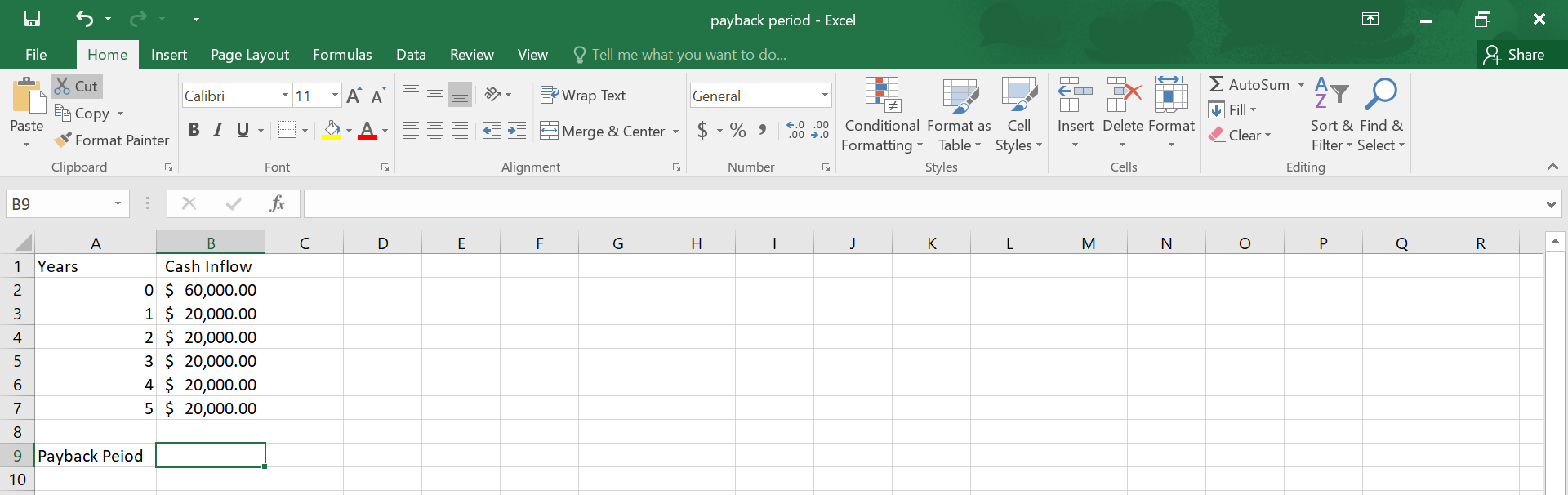

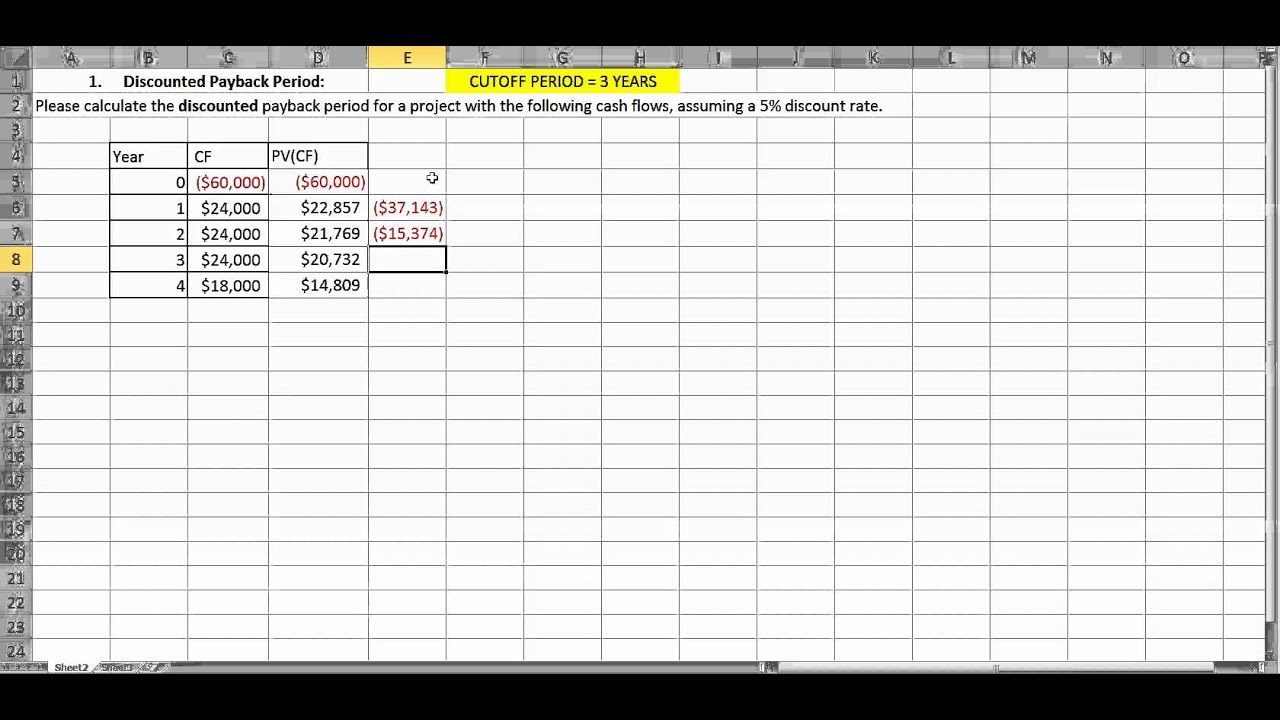

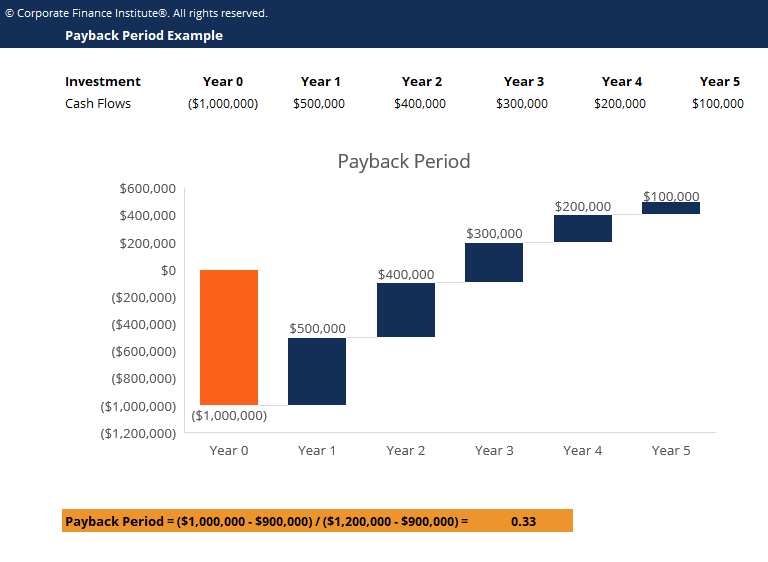

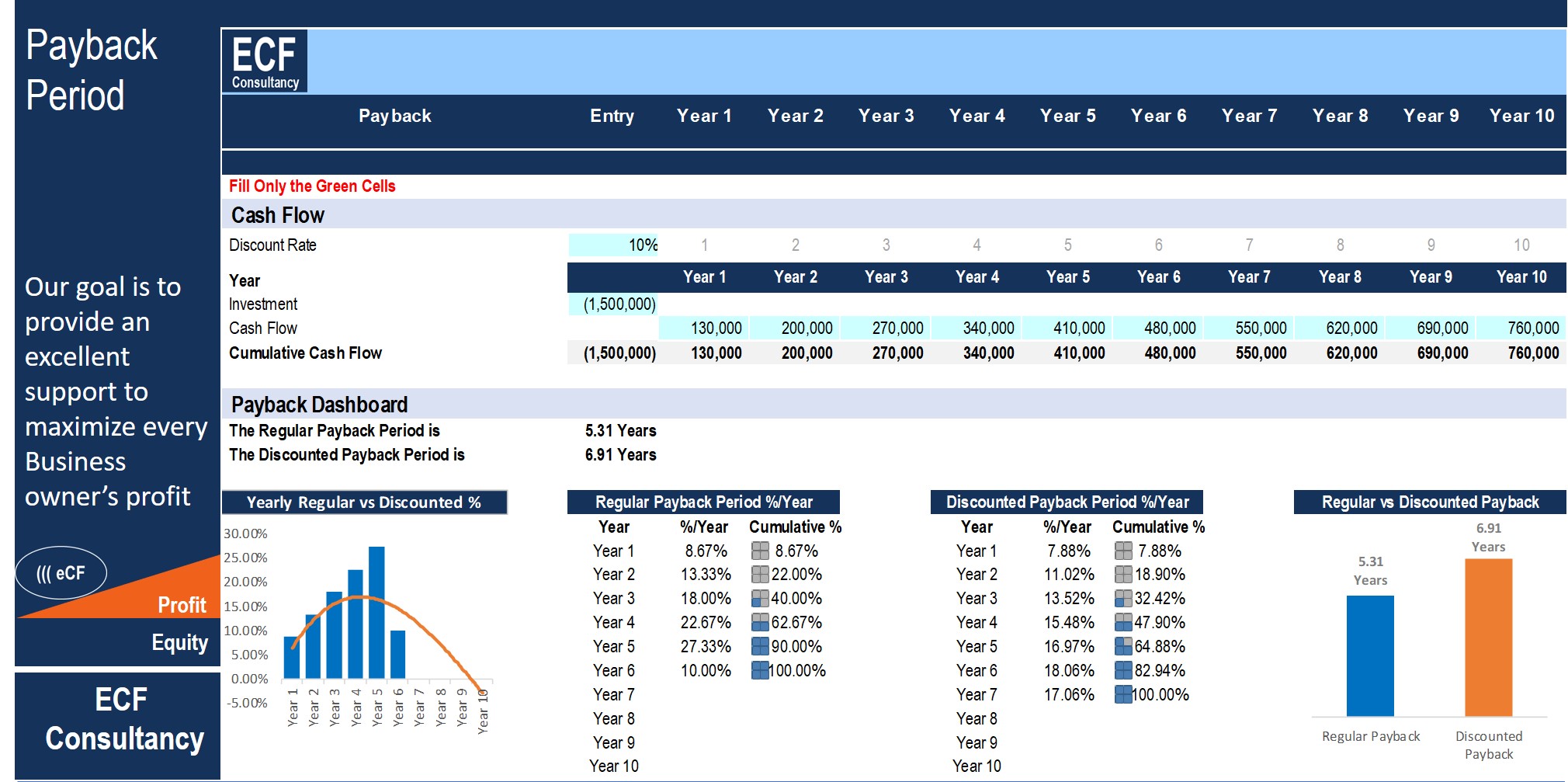

Payback Period Excel Template - Find the fraction needed, using the number of years with negative cash flow as index. As such, the payback period for this project is 2.33 years. The decision rule using the payback period is to minimize the. Web by elearnmarkets august 25, 2022 in fundamental analysis reading time: Web so, you calculate the payback period in excel by using the following steps: Use the formula “ index ”. Web use the formula “ if ”. Web june 19, 2023 how to calculate payback period in excel as a financial analyst, one of the key metrics you need to understand is the payback period. Web description what is payback period? Web the payback period template offers a great tool to calculate the payback periods with estimates on your average returns, schedules of investments, cumulative. Payback period in capital budgeting refers to the period of time required for the return on an investment to “repay”. Web description what is payback period? Find the fraction needed, using the number of years with negative cash flow as index. Use the formula “ index ”. If your data contains both cash inflows and cash outflows, calculate “net cash. The decision rule using the payback period is to minimize the. As such, the payback period for this project is 2.33 years. Use the formula “ index ”. Find the fraction needed, using the number of years with negative cash flow as index. Web the payback period template offers a great tool to calculate the payback periods with estimates on. To get the exact payback period, sum. If they are the same (even) then the formula is as follows; If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and. Use the formula “ index ”. Web june 19, 2023 how to calculate payback period in excel as a financial analyst, one of the key metrics you need to understand is the payback period. Web applying the formula provides the following: Web the equation for payback period depends whether the cash inflows are the same or uneven. Web description what. Enter financial data in your excel worksheet. The decision rule using the payback period is to minimize the. The payback period helps us to calculate the time taken to. Web use the formula “ if ”. To get the exact payback period, sum. Web how to calculate payback period in excel. To get the exact payback period, sum. Web $400k ÷ $200k = 2 years Web the equation for payback period depends whether the cash inflows are the same or uneven. Web the payback period template offers a great tool to calculate the payback periods with estimates on your average returns, schedules of. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and payback period from. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Аdd a column with the cumulative cash flows for each period, i.e. Web this capital investment. The decision rule using the payback period is to minimize the. Payback period in capital budgeting refers to the period of time required for the return on an investment to “repay”. Web the payback period template offers a great tool to calculate the payback periods with estimates on your average returns, schedules of investments, cumulative. Аdd a column with the. Аdd a column with the cumulative cash flows for each period, i.e. Web the payback period template offers a great tool to calculate the payback periods with estimates on your average returns, schedules of investments, cumulative. Payback period in capital budgeting refers to the period of time required for the return on an investment to “repay”. Web this capital investment. Enter financial data in your excel worksheet. Web the payback period template offers a great tool to calculate the payback periods with estimates on your average returns, schedules of investments, cumulative. Web so, you calculate the payback period in excel by using the following steps: Web use the formula “ if ”. Web applying the formula provides the following: To get the exact payback period, sum. Web this capital investment model template will help you calculate key valuation metrics of a capital investment including the cash flows, net present value (npv), internal. Web so, you calculate the payback period in excel by using the following steps: Аdd a column with the cumulative cash flows for each period, i.e. As such, the payback period for this project is 2.33 years. Web $400k ÷ $200k = 2 years The payback period helps us to calculate the time taken to. Web by elearnmarkets august 25, 2022 in fundamental analysis reading time: 8 mins read 0 listen to this: Web the equation for payback period depends whether the cash inflows are the same or uneven. Find the fraction needed, using the number of years with negative cash flow as index. Payback period in capital budgeting refers to the period of time required for the return on an investment to “repay”. Enter financial data in your excel worksheet. Web june 19, 2023 how to calculate payback period in excel as a financial analyst, one of the key metrics you need to understand is the payback period. Use the formula “ index ”. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and payback period from. The decision rule using the payback period is to minimize the. Web applying the formula provides the following: Web the payback period template offers a great tool to calculate the payback periods with estimates on your average returns, schedules of investments, cumulative. The payback period helps to determine the length of time required to recover the initial cash flow outlay in the project. Web by elearnmarkets august 25, 2022 in fundamental analysis reading time: Payback period in capital budgeting refers to the period of time required for the return on an investment to “repay”. Web the payback period template offers a great tool to calculate the payback periods with estimates on your average returns, schedules of investments, cumulative. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web $400k ÷ $200k = 2 years To get the exact payback period, sum. Web description what is payback period? 8 mins read 0 listen to this: Web how to calculate payback period in excel. Аdd a column with the cumulative cash flows for each period, i.e. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and payback period from. Web applying the formula provides the following: Web so, you calculate the payback period in excel by using the following steps: The payback period helps us to calculate the time taken to. Find the fraction needed, using the number of years with negative cash flow as index. Web this capital investment model template will help you calculate key valuation metrics of a capital investment including the cash flows, net present value (npv), internal.Payback Period Template Project Finance Analytical Methods Project

Payback Period.mp4 YouTube

How to Calculate Accounting Payback Period or Capital Budgeting Break

How to Calculate Payback Period in Excel.

How to Calculate Payback Period in Excel (With Easy Steps)

Payback Time Formula Excel BHe

Payback Period Excel Template PDF Template

Payback Period Template Download Free Excel Template

Payback Period Excel Model Eloquens

Payback Period Excel Template CFI Marketplace

Use The Formula “ Index ”.

Web Use The Formula “ If ”.

Enter Financial Data In Your Excel Worksheet.

The Decision Rule Using The Payback Period Is To Minimize The.

Related Post: