Real Estate Financial Modeling Excel Template

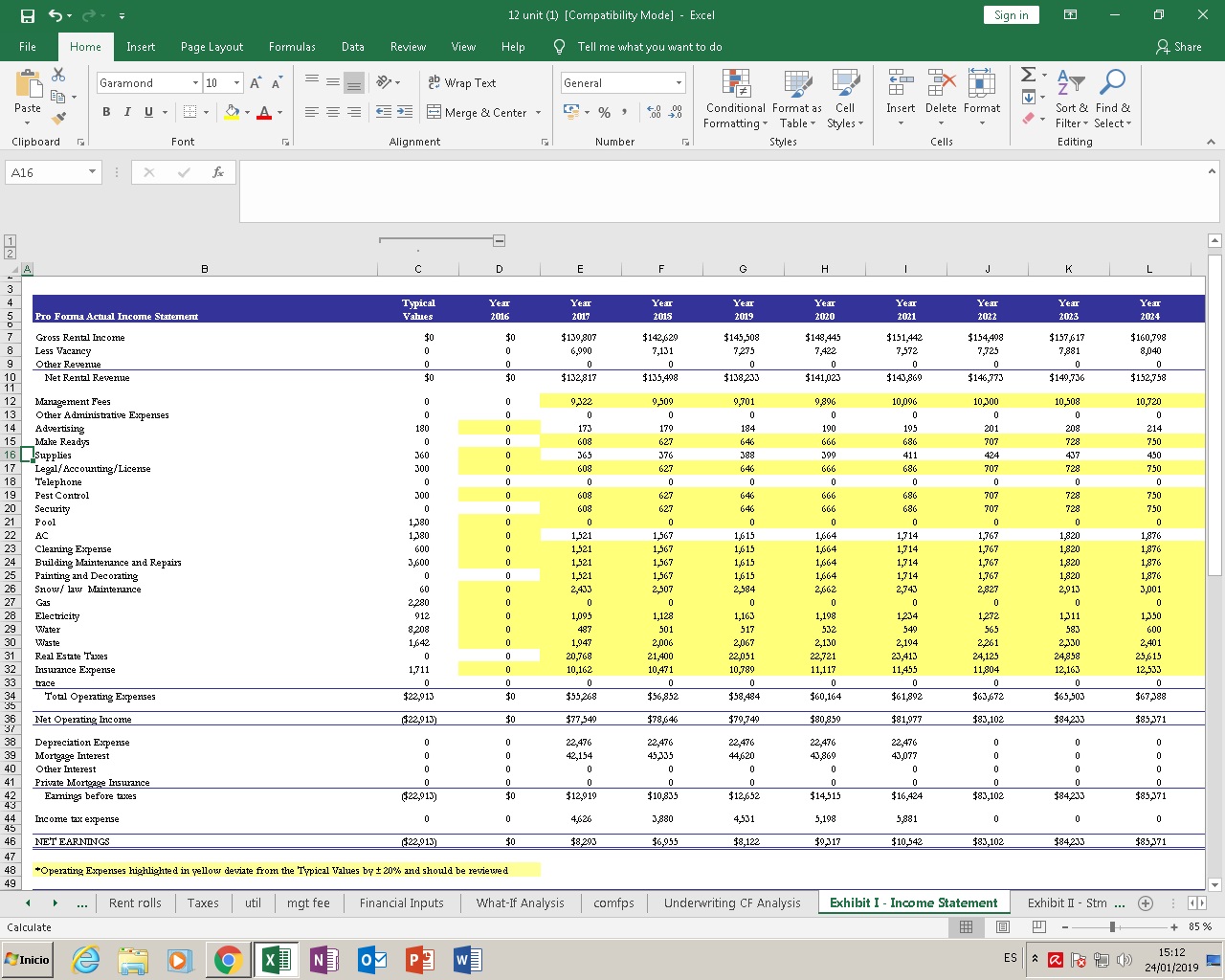

Real Estate Financial Modeling Excel Template - Calculate operating expenses step 4. Forecast capital expenditure step 5. Create a monthly build forecast step 2. All of our templates are. Web real estate multi family value add (buy, improve, hold and sell) financial model. How to invest in reit. Web that’s why we offer a suite of professionally developed excel models for apartment building acquisition financial modeling, from core through value add. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform. Web build an interactive financial model to assess a project’s financial viability. Web an lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded. Web list of free excel financial model templates. Web real estate multi family value add (buy, improve, hold and sell) financial model. Calculate operating expenses step 4. Web there are many reit valuation model excel templates you could use from here to help assess the potential risks and returns of this venture. Web the cap table template in our real. Web an lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded. Web specialized financial models for real estate and construction. Web that’s why we offer a suite of professionally developed excel models for apartment building acquisition financial modeling, from core through value. Web build an interactive financial model to assess a project’s financial viability. All of our templates are. Create a monthly build forecast step 2. Forecast capital expenditure step 5. Input historical financial information into excel; Understand how to project real estate financing (both debt and equity) flow in and out depending on. Web that’s why we offer a suite of professionally developed excel models for apartment building acquisition financial modeling, from core through value add. Web these financial templates cover every aspect of a real estate transaction such as valuation, financial projection, calculation of key. If you want examples of these specialized models, please see our coverage below: Web there are many reit valuation model excel templates you could use from here to help assess the potential risks and returns of this venture. Web build an interactive financial model to assess a project’s financial viability. Determine the assumptions that will. Web that’s why we offer. Understand how to project real estate financing (both debt and equity) flow in and out depending on. Input historical financial information into excel; Web specialized financial models for real estate and construction. If you want examples of these specialized models, please see our coverage below: Forecast rental income step 3. All of our templates are. Web list of free excel financial model templates. Web that’s why we offer a suite of professionally developed excel models for apartment building acquisition financial modeling, from core through value add. Web there are many reit valuation model excel templates you could use from here to help assess the potential risks and returns of this. Web build an interactive financial model to assess a project’s financial viability. Create a monthly build forecast step 2. Web list of free excel financial model templates. How to invest in reit. Forecast rental income step 3. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform. Understand how to project real estate financing (both debt and equity) flow in and out depending on. If you want examples of these specialized models, please see our coverage below: Web real estate multi family value add (buy, improve, hold and sell). Web list of free excel financial model templates. Web there are many reit valuation model excel templates you could use from here to help assess the potential risks and returns of this venture. Input historical financial information into excel; All of our templates are. Web these financial templates cover every aspect of a real estate transaction such as valuation, financial. Web refm’s template spreadsheet takes away the need to hire costly financial analysts and puts you in complete control of your project. Web the cap table template in our real estate agency financial model excel template includes four rounds of financing, and it shows how the shares issued to new investors. Web these financial templates cover every aspect of a real estate transaction such as valuation, financial projection, calculation of key financial ratios, etc. Web an lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded. Web there are many reit valuation model excel templates you could use from here to help assess the potential risks and returns of this venture. Understand how to project real estate financing (both debt and equity) flow in and out depending on. Web build an interactive financial model to assess a project’s financial viability. Forecast capital expenditure step 5. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform. Create a monthly build forecast step 2. Determine the assumptions that will. Web real estate multi family value add (buy, improve, hold and sell) financial model. Web list of free excel financial model templates. Forecast rental income step 3. Web that’s why we offer a suite of professionally developed excel models for apartment building acquisition financial modeling, from core through value add. If you want examples of these specialized models, please see our coverage below: Web specialized financial models for real estate and construction. How to invest in reit. All of our templates are. Calculate operating expenses step 4. Forecast capital expenditure step 5. How to invest in reit. Create a monthly build forecast step 2. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform. Web build an interactive financial model to assess a project’s financial viability. Forecast rental income step 3. Web the cap table template in our real estate agency financial model excel template includes four rounds of financing, and it shows how the shares issued to new investors. Web there are many reit valuation model excel templates you could use from here to help assess the potential risks and returns of this venture. Calculate operating expenses step 4. Web real estate multi family value add (buy, improve, hold and sell) financial model. Web these financial templates cover every aspect of a real estate transaction such as valuation, financial projection, calculation of key financial ratios, etc. Web an lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded. Web that’s why we offer a suite of professionally developed excel models for apartment building acquisition financial modeling, from core through value add. Determine the assumptions that will. Understand how to project real estate financing (both debt and equity) flow in and out depending on. If you want examples of these specialized models, please see our coverage below:Browse Our Image of Commercial Property Budget Template Spreadsheet

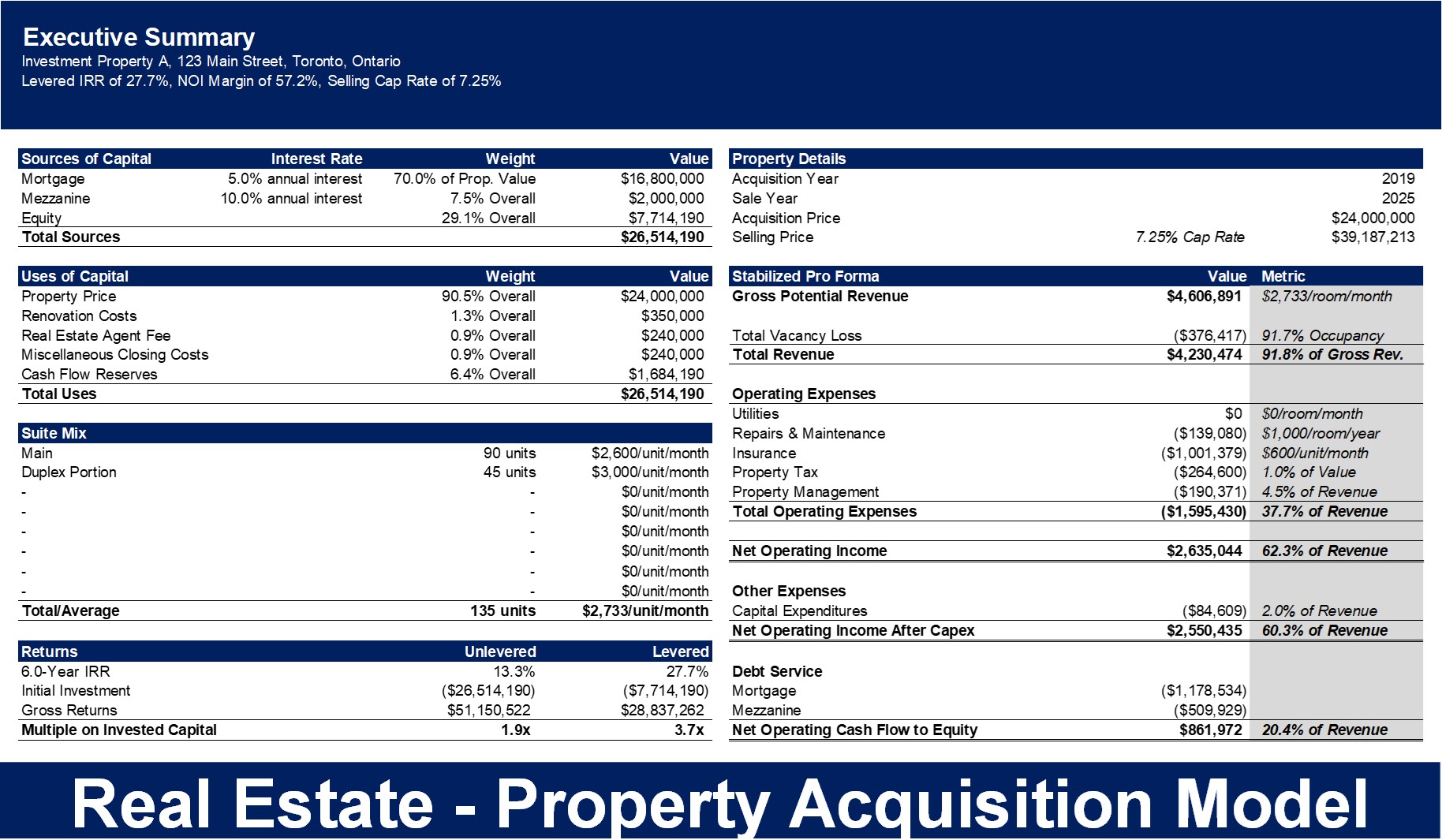

Real Estate Property Acquisition Excel Model Template Eloquens

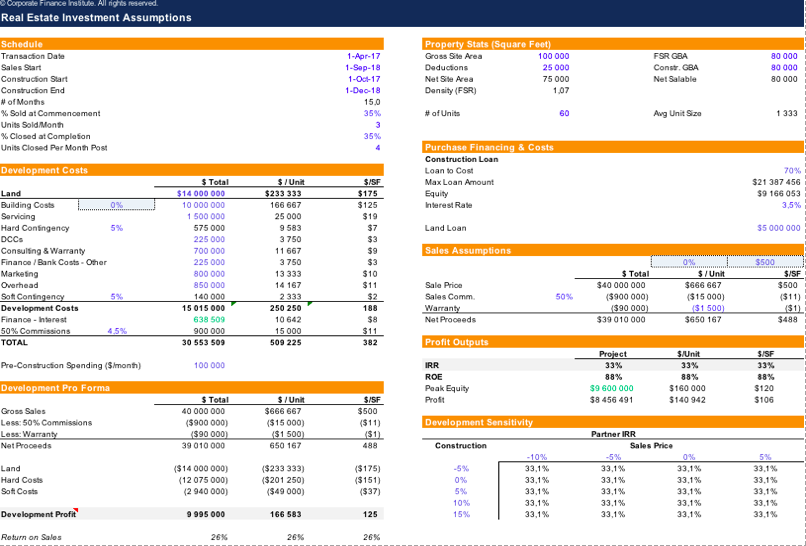

Valuation Model Template eFinancialModels Spreadsheet

Free Spreadsheet Templates Finance Excel Templates eFinancialModels

Real Estate Excel Financial Model Template Eloquens

Real Estate Financial Modeling Excel Template Free FREE PRINTABLE

Corporate Finance Institute

金融模型模板包 12+型号,DCF,LBO,并购 德赢下载

Real Estate Excel Financial Model Template CFI Marketplace

Real Estate Financial Model Excel Template for Complete Valuation with

Web List Of Free Excel Financial Model Templates.

All Of Our Templates Are.

Input Historical Financial Information Into Excel;

Web Refm’s Template Spreadsheet Takes Away The Need To Hire Costly Financial Analysts And Puts You In Complete Control Of Your Project.

Related Post: