Real Estate Mileage Log Template

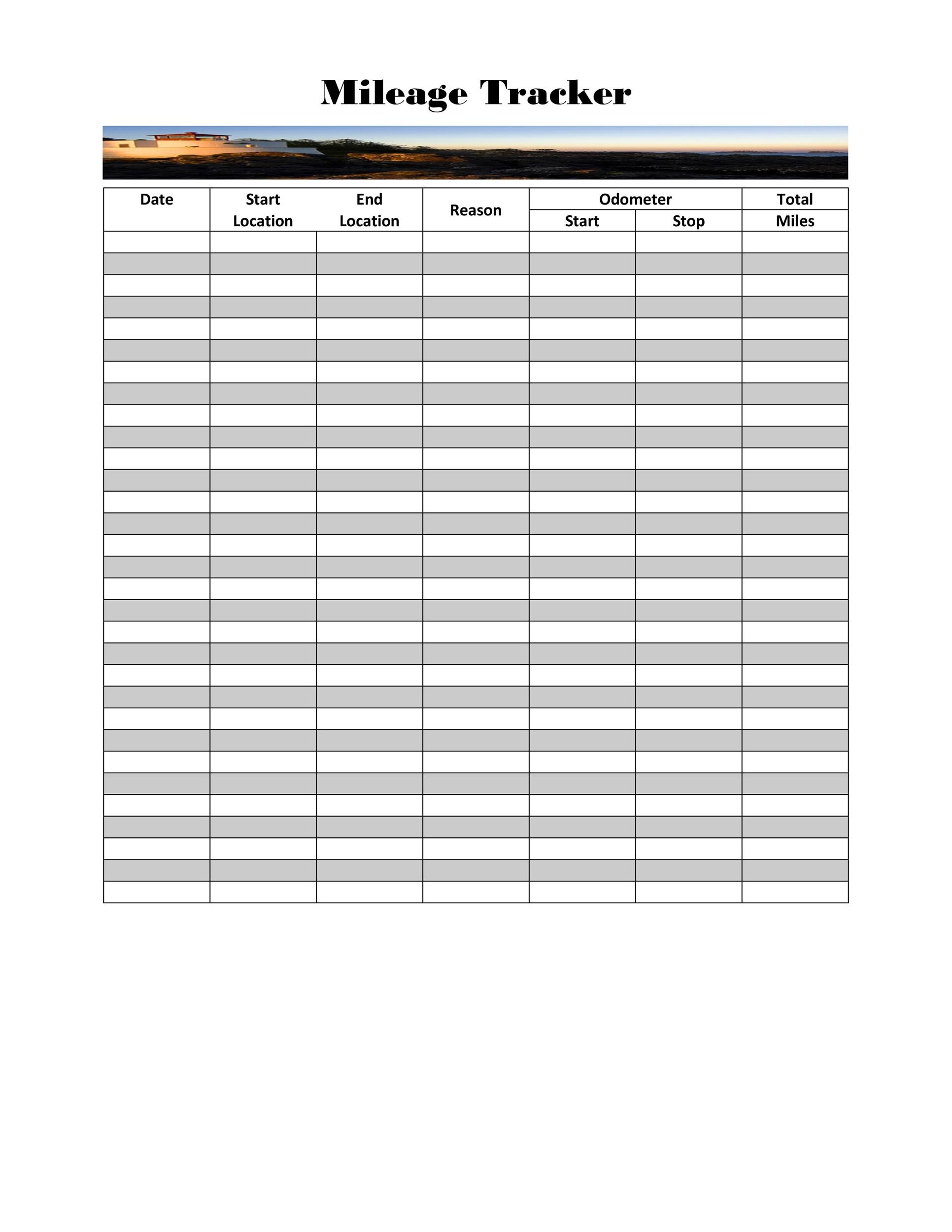

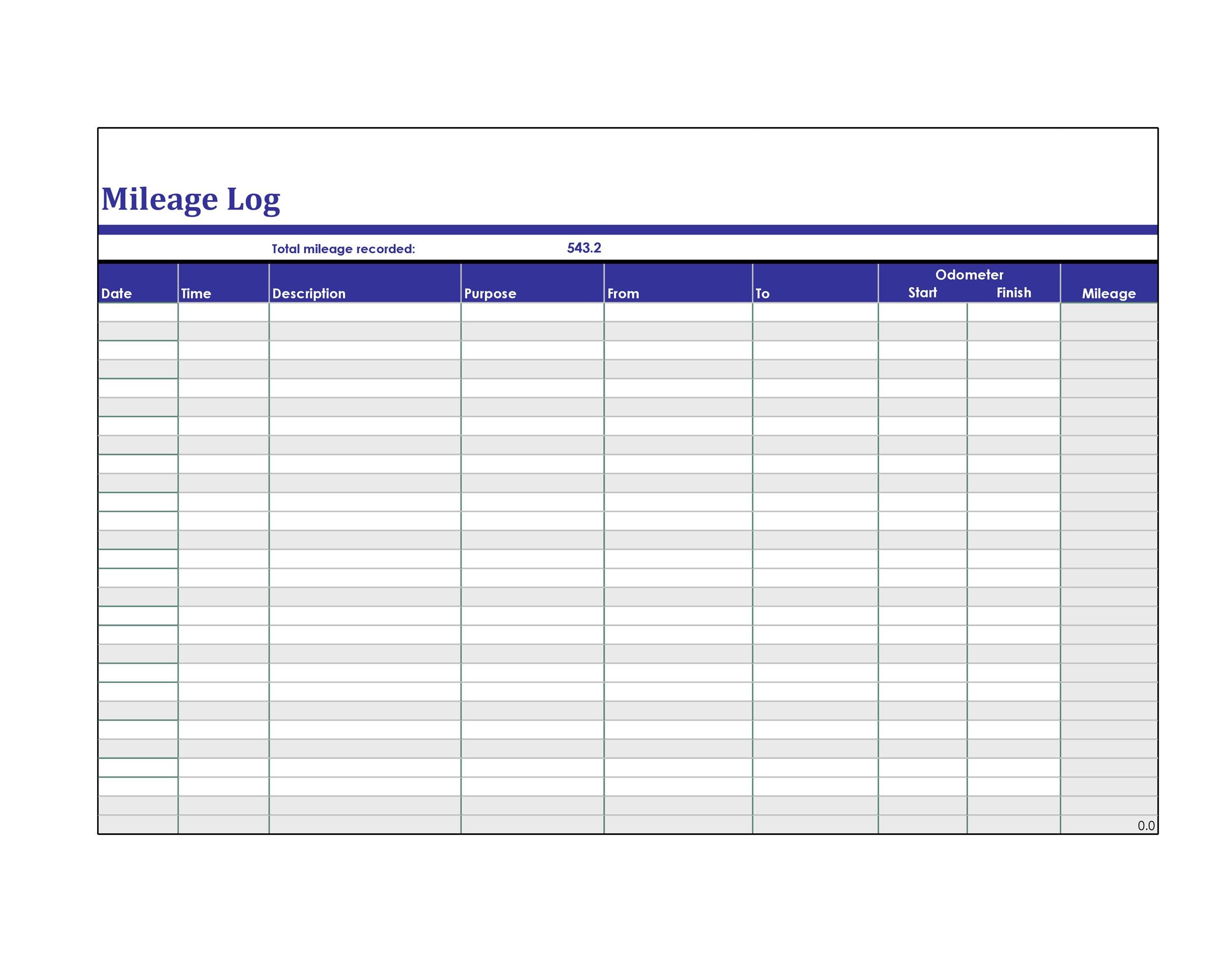

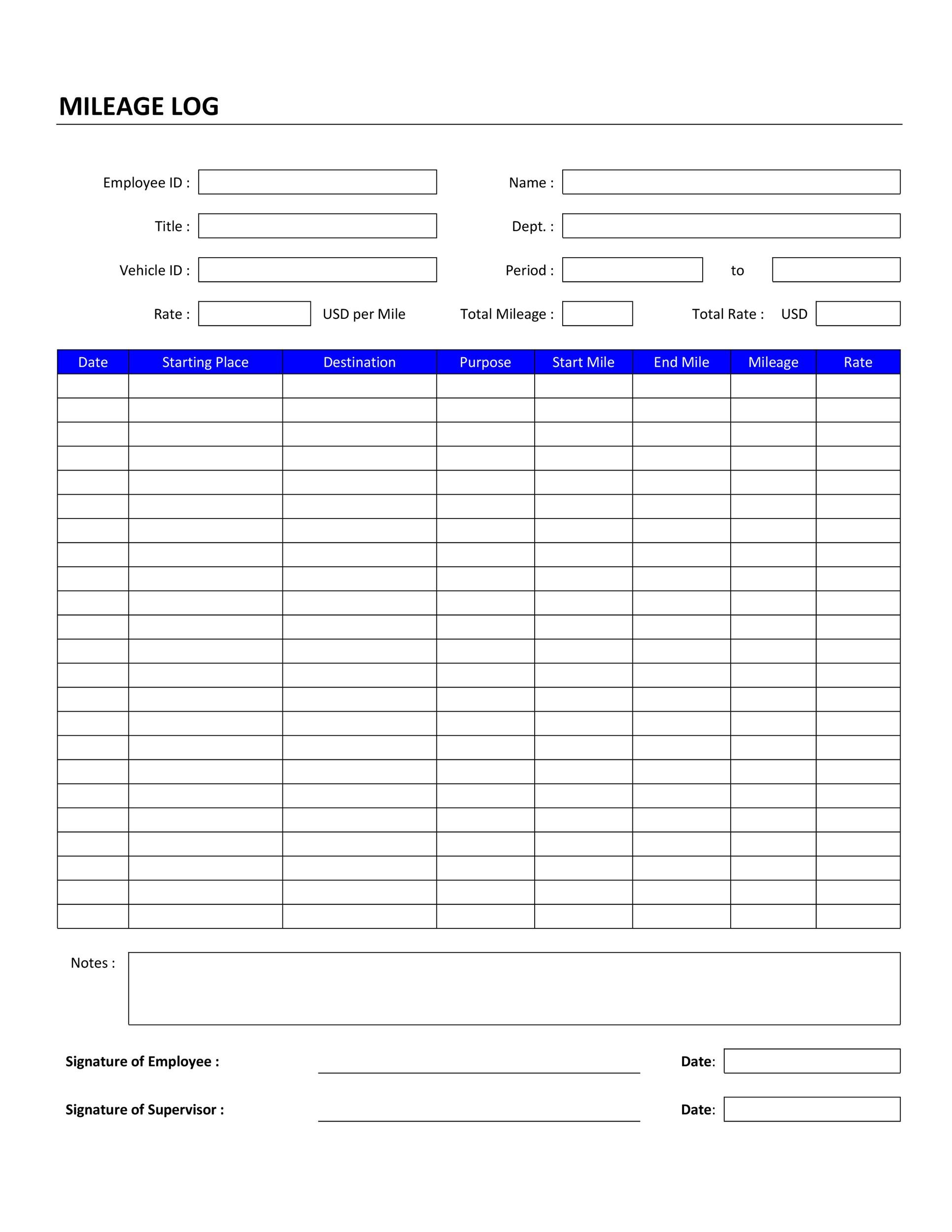

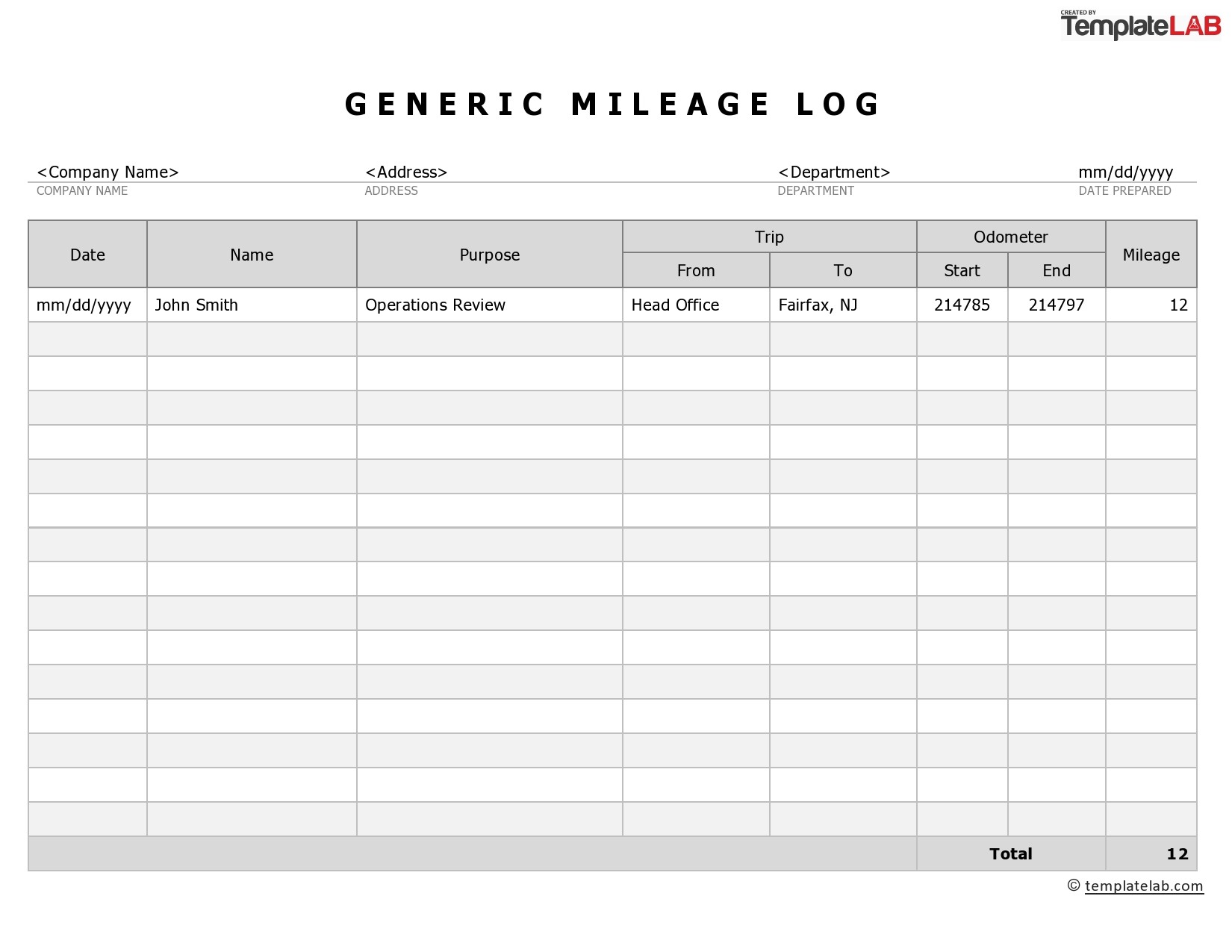

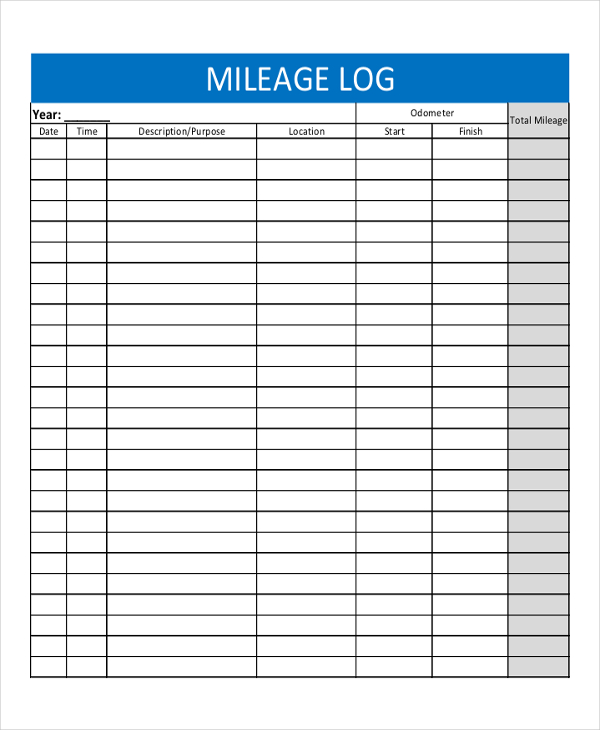

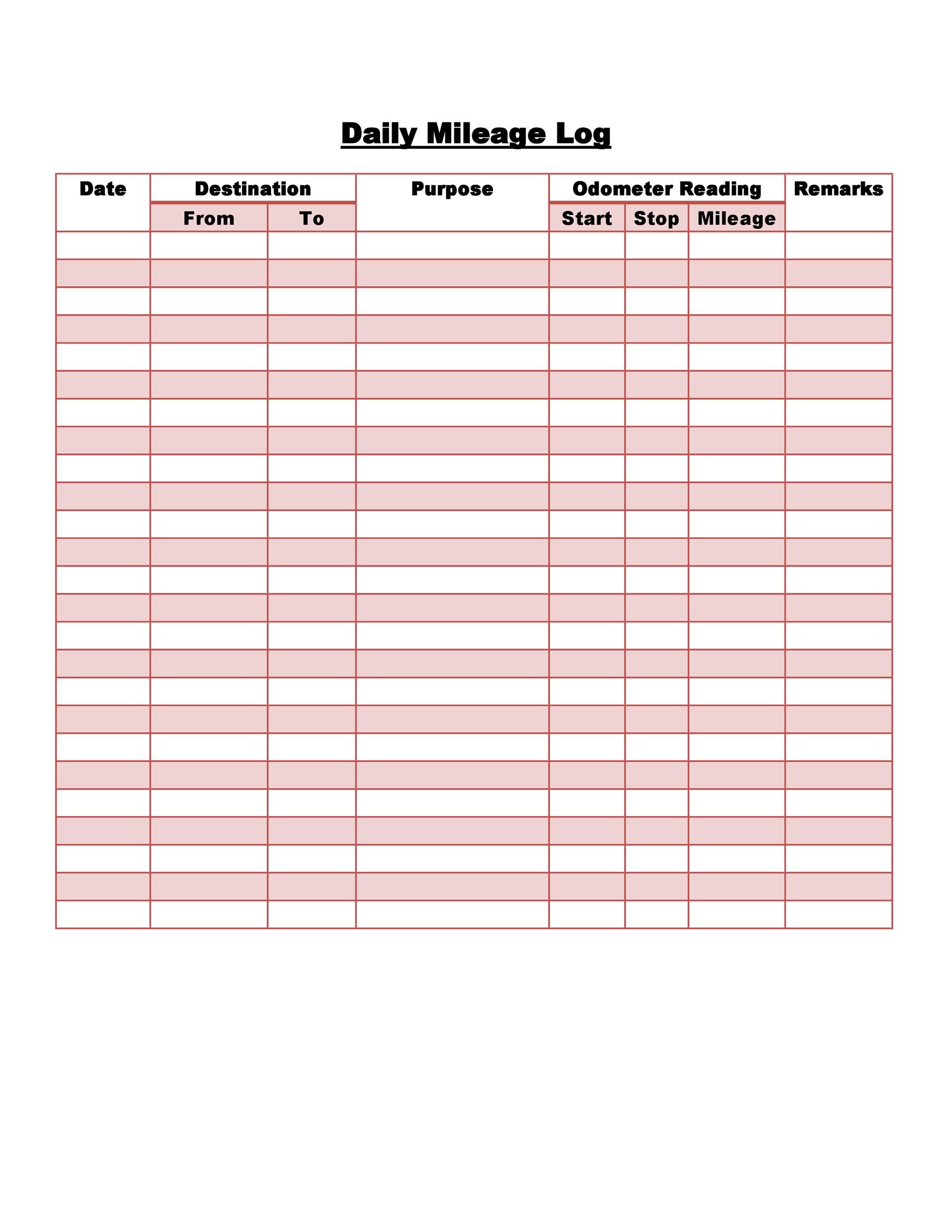

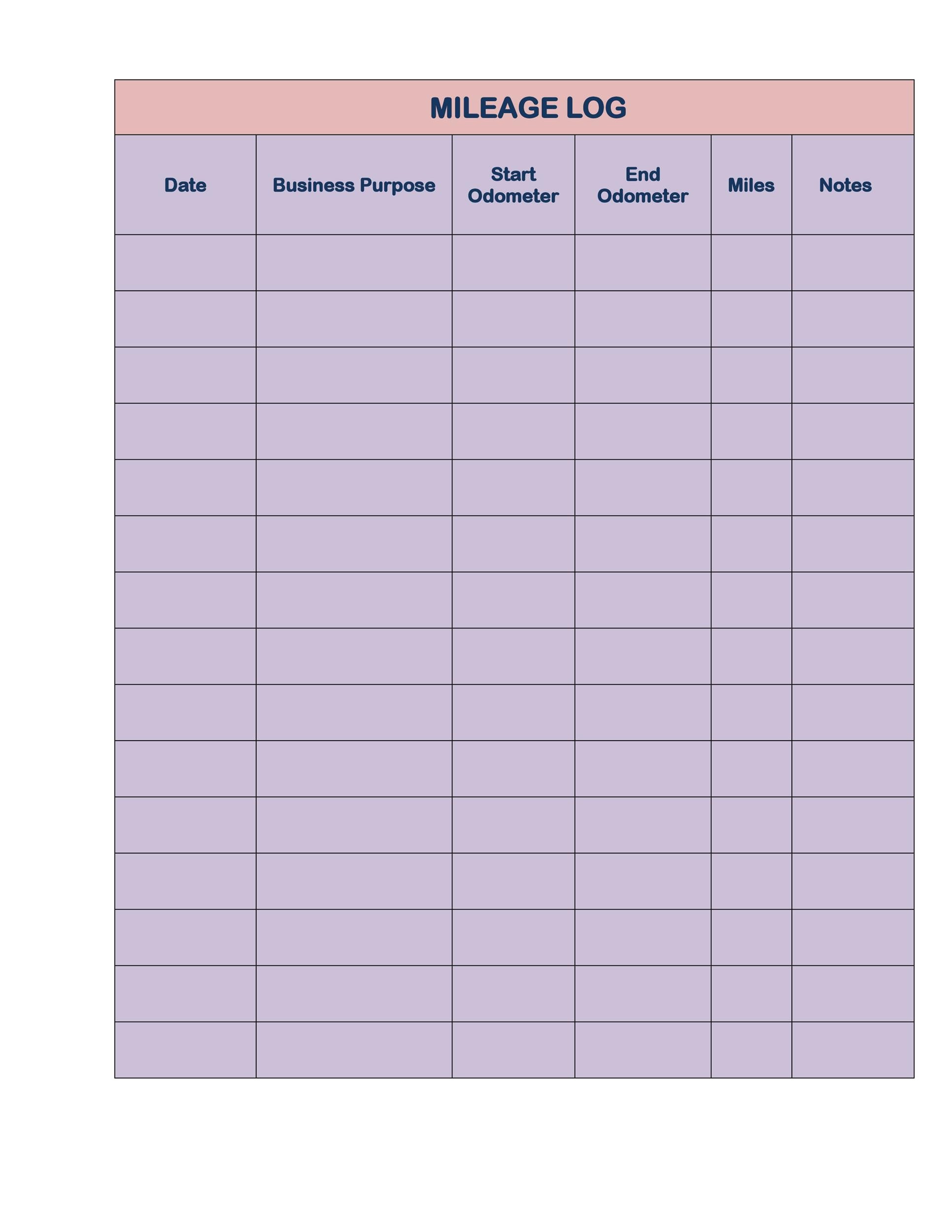

Real Estate Mileage Log Template - The template includes the date of travel, the going, the purpose of one trip, the beginning and ending. She is a real estate agent who has had 5 clients. Standard mileage deduction and actual expense method. Web the 2022 standard mileage rate for business purposes is 65.6 cents/mile in 2023. Web 1036 w charlotte street, moses lake, wa 98837. These free printable mileage logs are sufficient to meet the irs’s basic requirements. Web privately owned vehicle (pov) mileage reimbursement rates. The template includes the date of travel, the destination, the purpose of the trip, the starting and. Web using the standard mileage rate, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it comes time to file your taxes on. Web check out our comprehensive list of rental forms and templates for both landlord and tenant use. For 2021, 2022, or 2023. Web the landlord will provide a copy of the completed and signed move in checklist to the tenant. Let’s look at emma for instance. Web the template includes the date are travel, the your, the purpose of the trip, who starting and ending mileage, and of whole miles driven for business purposes. The template includes. Web 1036 w charlotte street, moses lake, wa 98837. There are two methods of calculation that you can choose i.e. Let’s look at emma for instance. Reduce your transport costs first and foremost, the tools offered by a realtor mileage log help. 4 bds2 ba1,506 sqft active. Which template includes the date concerning travel, the destinations, the purpose of which. Web get the authentic estate mileage log as a pdf, sheets or excel. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Web feel free to download our excel mileage log template. Web mileage log template | jotform tables esc mileage log use template. Includes lease agreements and more. These free printable mileage logs are sufficient to meet the irs’s basic requirements. Which template includes the date concerning travel, the destinations, the purpose of which. 4 bds2 ba1,506 sqft active. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Web get the authentic estate mileage log as a pdf, sheets or excel. At this point the tenant and landlord should agree upon a plan. Using a real estate mileage log template. Web the template uses the standard irs mileage value for 2023. Standard mileage deduction and actual expense method. Web the template includes the date are travel, the your, the purpose of the trip, who starting and ending mileage, and of whole miles driven for business purposes. There are two methods of calculation that you can choose i.e. Web mileage log template | jotform tables esc mileage log use template shared by. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. The template includes the date of travel, the going, the purpose of one trip, the beginning and ending. Includes lease agreements and more. Using a real estate mileage log template. At this point the tenant and landlord should agree upon a plan. 1322 w bonneville street, moses lake, wa 98837. Includes lease agreements and more. These free printable mileage logs are sufficient to meet the irs’s basic requirements. The template includes the date of travel, the destination, the purpose of the trip, the starting and. Web 1036 w charlotte street, moses lake, wa 98837. 1322 w bonneville street, moses lake, wa 98837. Web the template includes the date are travel, the your, the purpose of the trip, who starting and ending mileage, and of whole miles driven for business purposes. The template includes the date of travel, the going, the purpose of one trip, the beginning and ending. Web get the real estate mileage. Web using the standard mileage rate, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it comes time to file your taxes on. Standard mileage deduction and actual expense method. At this point the tenant and landlord should agree upon a plan. 4 bds2 ba1,506 sqft active. Let’s look at emma for. The template includes the date of travel, the destination, the purpose of the trip, the starting and. Includes lease agreements and more. Web feel free to download our excel mileage log template. Let’s look at emma for instance. Web mileage log template | jotform tables esc mileage log use template shared by jotform in log sheets cloned 697 a mileage log is a record of the number of miles a. Web get the real estate mileage log as a pdf, sheets or excel. Web using the standard mileage rate, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it comes time to file your taxes on. There are two methods of calculation that you can choose i.e. Web the template uses the standard irs mileage value for 2023. Web the landlord will provide a copy of the completed and signed move in checklist to the tenant. Web the template includes the date are travel, the your, the purpose of the trip, who starting and ending mileage, and of whole miles driven for business purposes. Using a real estate mileage log template. Reduce your transport costs first and foremost, the tools offered by a realtor mileage log help. Web with an array of features, the mileiq real estate agent mileage log allows you to: Web privately owned vehicle (pov) mileage reimbursement rates. These free printable mileage logs are sufficient to meet the irs’s basic requirements. Standard mileage deduction and actual expense method. Web get the authentic estate mileage log as a pdf, sheets or excel. Web check out our comprehensive list of rental forms and templates for both landlord and tenant use. At this point the tenant and landlord should agree upon a plan. Includes lease agreements and more. She is a real estate agent who has had 5 clients. Web 1036 w charlotte street, moses lake, wa 98837. Web the 2022 standard mileage rate for business purposes is 65.6 cents/mile in 2023. Web mileage log template | jotform tables esc mileage log use template shared by jotform in log sheets cloned 697 a mileage log is a record of the number of miles a. There are two methods of calculation that you can choose i.e. Which template includes the date concerning travel, the destinations, the purpose of which. Get that real estate length log as a pdf, sheets or excel. Web feel free to download our excel mileage log template. 4 bds2 ba1,506 sqft active. These free printable mileage logs are sufficient to meet the irs’s basic requirements. Web using the standard mileage rate, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it comes time to file your taxes on. Standard mileage deduction and actual expense method. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2023. Web privately owned vehicle (pov) mileage reimbursement rates. Web the template includes the date are travel, the your, the purpose of the trip, who starting and ending mileage, and of whole miles driven for business purposes.FREE 17+ Sample Mileage Log Templates in MS Word MS Excel Pages

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Mileage Log Templates 19+ Free Printable Word, Excel & PDF Formats

Awesome Real Estate Mileage Log Template in 2021 Meeting agenda

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

13+ Log Templates Free Sample, Example, Format Free & Premium Templates

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Through A Real Estate Length Log Template Can Save You Time And Assistance You Stay Organized.

Reduce Your Transport Costs First And Foremost, The Tools Offered By A Realtor Mileage Log Help.

The Template Includes The Date Of Travel, The Going, The Purpose Of One Trip, The Beginning And Ending.

At This Point The Tenant And Landlord Should Agree Upon A Plan.

Related Post: