Secured Promissory Note Template

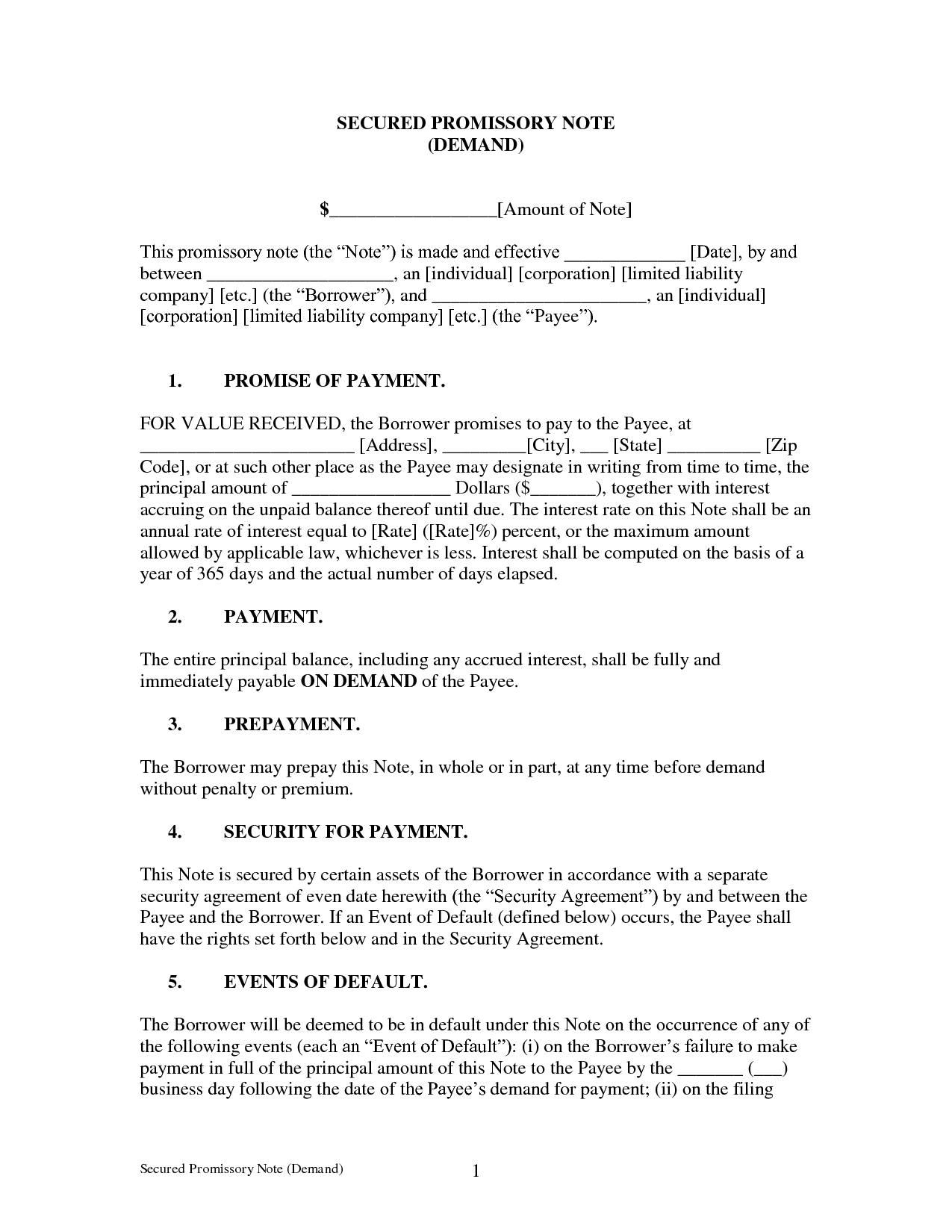

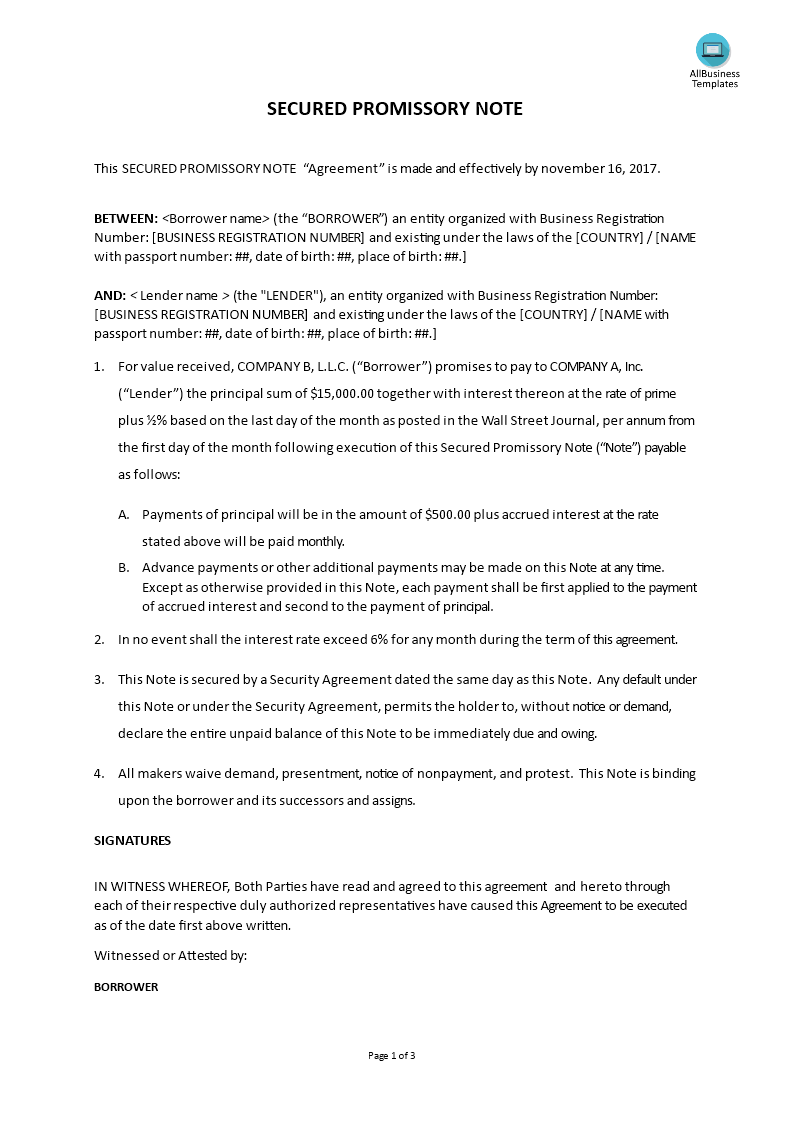

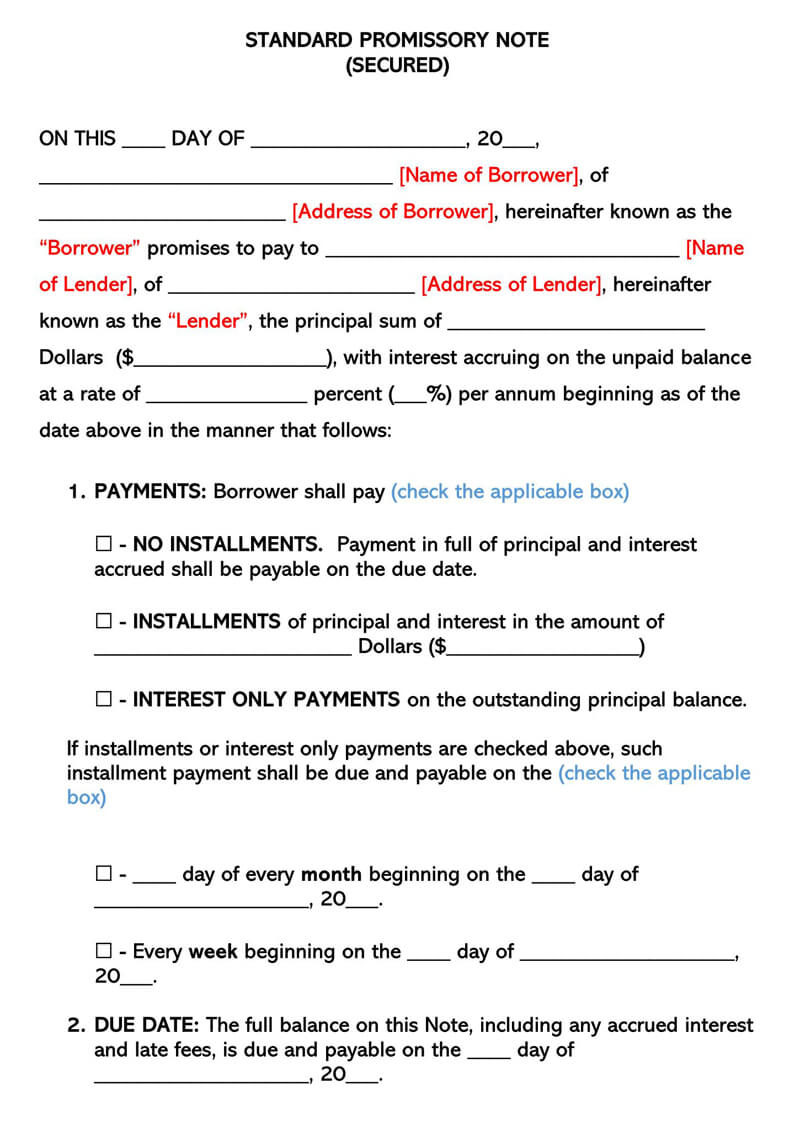

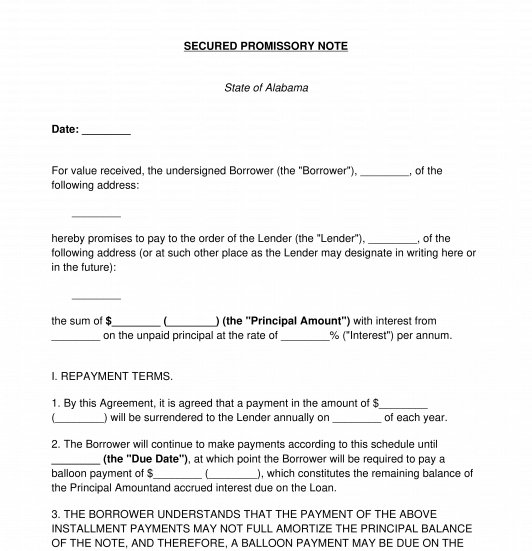

Secured Promissory Note Template - Our premium editable template was created in collaboration with experts to help you create a secured promissory note that can be shared online. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. Remember, most lenders will not agree to lend to you if you do not have a secured promissory note pdf. Web whereas it is best to work with a lawyer when making a secured promissory note, you, as the lender, can make a promissory note yourself. Web decide whether you want the note to be secured by collateral, or unsecured. Web there are two (2) main types of promissory notes: These are the secured and the unsecured promissory notes. This note is secured by a security instrument described in section 17 securing repayment of this note, the property described in such security instrument may not be sold or transferred without the lender’s consent. Both a secured promissory note and an unsecured promissory note are made to help outline the details of the relationship between a borrower and a lender. This is a promissory note that is accompanied or backed by other crucial documents as collateral. Web a secured promissory note is a contract used for ensuring a borrower pays a loaned sum of money back (plus interest) to the person or entity that lent it. Fill in the details of the template as thoroughly as possible. We look into them here below: Any notices required or permitted to be given hereunder shall be given in. Web it is fast and simple to get what you need with a free secured promissory note template from rocket lawyer: Customize the template secured promissory note state of alabama date: Give your lender confidence by outlining the terms of your loan and repayment plan. Web secured promissory note template. We look into them here below: Web what does a promissory note do? Web here are free secured promissory note templates that can be customized as per need: Web download this secured promissory note template design in google docs, word, pdf format. There are quite a few promissory note templates and forms accessible online that can save time while drafting a new note. Web decide whether. Web a secured promissory note is one that is backed by some type of collateral. The form also contains a section which details various actions which would constitute default on. Customize the template secured promissory note state of alabama date: Provide identifying information about the borrower and lender. Use a secured promissory note template as a starting point for creating. Web whereas it is best to work with a lawyer when making a secured promissory note, you, as the lender, can make a promissory note yourself. Our premium editable template was created in collaboration with experts to help you create a secured promissory note that can be shared online. Web there are two main kinds of promissory notes. Web secured. Web description secured promissory note sec. Define the due date of the loan and the terms of. Fill in the details of the template as thoroughly as possible. Web what is a secured promissory note? Remember, most lenders will not agree to lend to you if you do not have a secured promissory note pdf. Since it is “secured,” the borrower must provide one (1) or more assets to serve as collateral. Web there are two (2) main types of promissory notes: Any notices required or permitted to be given hereunder shall be given in This is a promissory note that is accompanied or backed by other crucial documents as collateral. Web a promissory note. Provide identifying information about the borrower and lender. Standard templates by state alabama alaska arizona arkansas california colorado connecticut delaware florida georgia hawaii idaho illinois indiana iowa kansas kentucky louisiana maine maryland massachusetts michigan minnesota mississippi missouri. Web there are two (2) main types of promissory notes: Our premium editable template was created in collaboration with experts to help you. Web a promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured, says wheeler. The terms of this note shall control over any conflicting terms in any referenced agreement or document. In the event of a default, those pieces of property may be used to redeem the amount owed. We look. This document makes sure that the borrower fulfills their promise to pay back the lender before the end date of the loan. These are the secured and the unsecured promissory notes. Web a secured promissory note is a contract used for ensuring a borrower pays a loaned sum of money back (plus interest) to the person or entity that lent. Fill in the details of the template as thoroughly as possible. A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Provide identifying information about the borrower and lender. Draft or download an unsecured promissory note template. Web what is a secured promissory note? Web here are free secured promissory note templates that can be customized as per need: Standard templates by state alabama alaska arizona arkansas california colorado connecticut delaware florida georgia hawaii idaho illinois indiana iowa kansas kentucky louisiana maine maryland massachusetts michigan minnesota mississippi missouri. Create a high quality document online now! Both a secured promissory note and an unsecured promissory note are made to help outline the details of the relationship between a borrower and a lender. This is a promissory note that is accompanied or backed by other crucial documents as collateral. Use a secured promissory note template as a starting point for creating your own document. Web download this secured promissory note template design in google docs, word, pdf format. This form is a secured promissory note. Web what does a promissory note do? Web secured promissory note: Any notices required or permitted to be given hereunder shall be given in All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it. Web it is fast and simple to get what you need with a free secured promissory note template from rocket lawyer: Web there are two (2) main types of promissory notes: We look into them here below: The amount to borrow, the terms of the lender and repayment intervals. We look into them here below: All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it. Web here are free secured promissory note templates that can be customized as per need: Web there are two (2) main types of promissory notes: These are the secured and the unsecured promissory notes. In the event of a default, those pieces of property may be used to redeem the amount owed. A promissory note refers to a written agreement to pay a specific amount of money by a set time to the lender named in the promissory note. The terms of this note shall control over any conflicting terms in any referenced agreement or document. A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Provide identifying information about the borrower and lender. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. The form also contains a section which details various actions which would constitute default on. Web download this secured promissory note template design in google docs, word, pdf format. Give your lender confidence by outlining the terms of your loan and repayment plan. Web a promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured, says wheeler.Secured Promissory Note Template Template Business

Secured Promissory Note Template PDFSimpli

Secured Promissory Note Templates at

Free Secured Promissory Note Templates (US) Word, PDF

Secured Promissory Note Template Database

Secured Promissory Note Template Word Template 1 Resume Examples

Secured promissory note template in Word and Pdf formats

Secured Promissory Note Template Word & PDF

Secured Promissory Note Templates (Free) [Word, PDF, ODT]

Secured Promissory Note Template Free Printable Documents

There Are Quite A Few Promissory Note Templates And Forms Accessible Online That Can Save Time While Drafting A New Note.

Web It Is Fast And Simple To Get What You Need With A Free Secured Promissory Note Template From Rocket Lawyer:

Define The Due Date Of The Loan And The Terms Of.

Web Description Secured Promissory Note Sec.

Related Post:

![Secured Promissory Note Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/03/Standard-Secured-Promissory-Note-Templates.Legal_.jpg)