Statement Of Final Return 941 Template

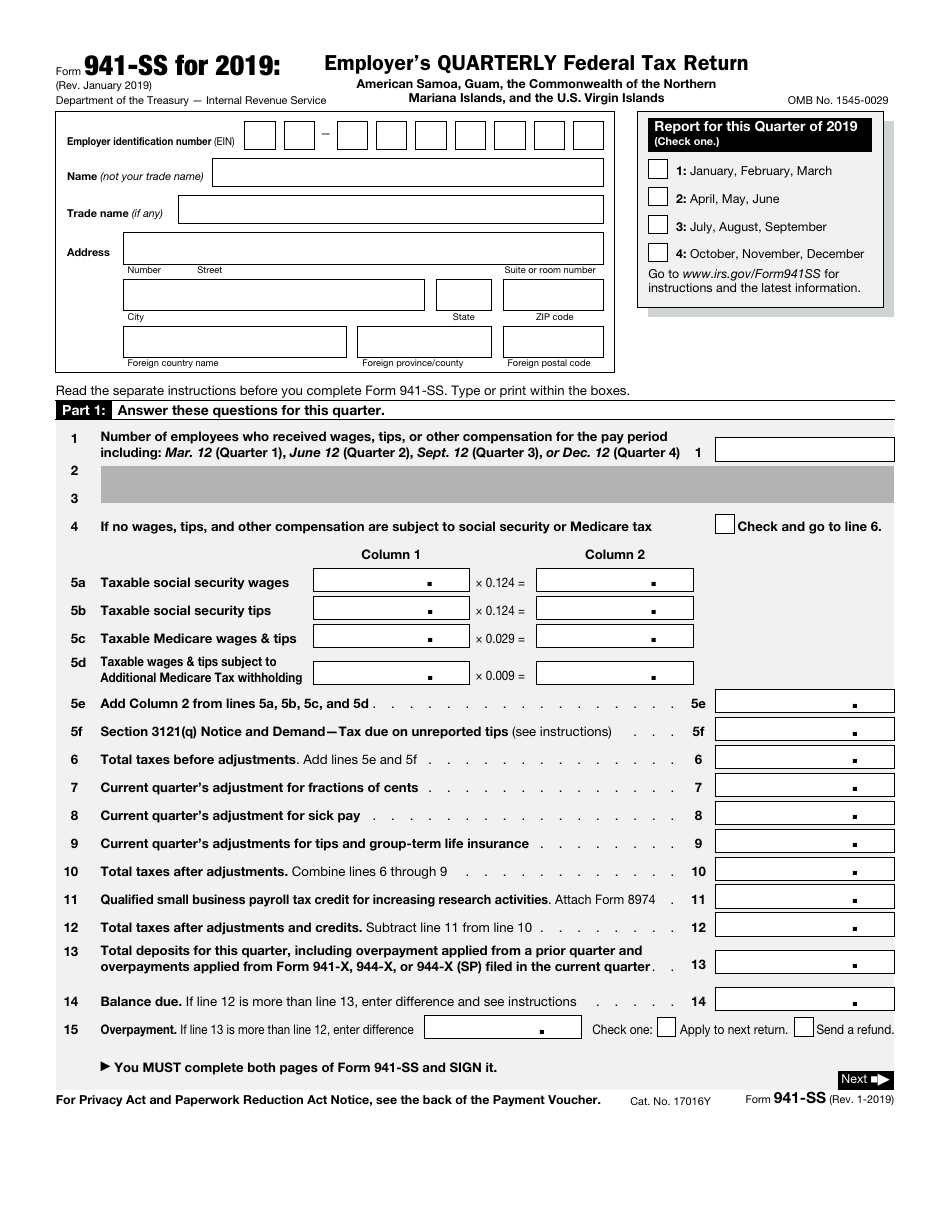

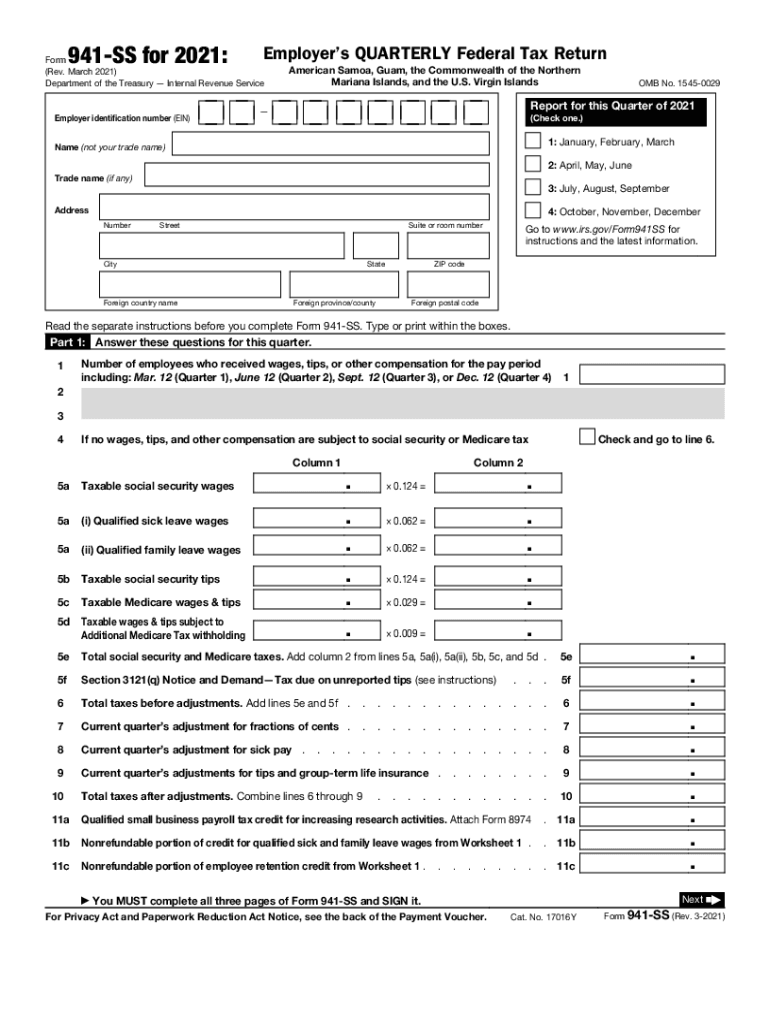

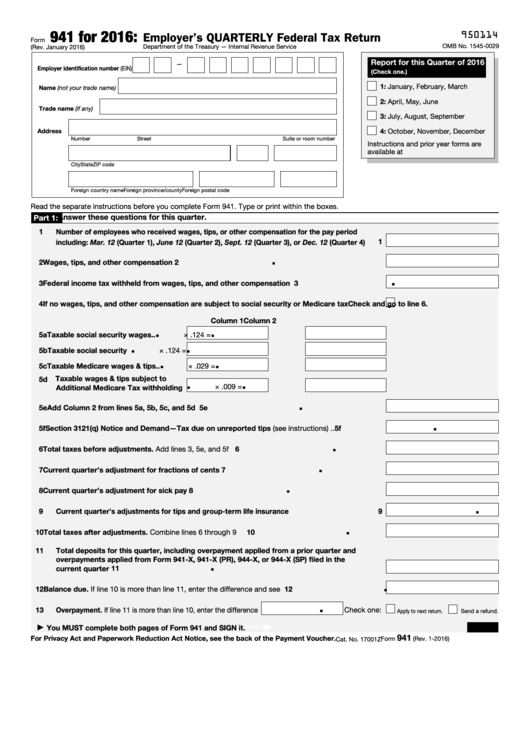

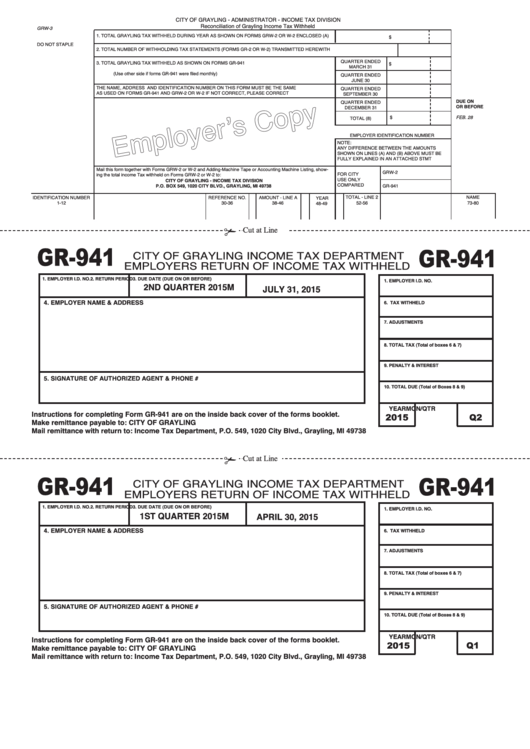

Statement Of Final Return 941 Template - Web choose setup > clients and click the payroll taxes tab. Mail 941 is spent by employers. Pay the employer's portion of social security or. Web form 941 for 2021: In the forms section, click the additional information button for the federal 94x form. Form 941 reports federal income. Web employers use form 941 to: Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Web information about form 941, employer's quarter federal tax refund, including recent updates, related forms, and instructions on like to file. Web i can help you mark a 941 return as final. Web what is form 941? Under status, select deceased on the dropdown menu, then click. Web information about form 941, employer's quarter federal tax refund, including recent updates, related forms, and instructions on like to file. Web choose setup > clients and click the payroll taxes tab. Web employers use form 941 to: Web employers use form 941 to: March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web pick the name of the employee on the list, then select the edit (pencil icon) beside employment. Web choose setup > clients and click the payroll taxes tab. Web a comprehensive federal, state & international tax resource. Web you can probably simply file another 941 with the box checked and the requisite statement attached (print and mail) in addition to which you can include a line. Pay the employer's portion of social security or. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web information about form 941, employer's quarter federal tax refund,. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web choose setup > clients and click the payroll taxes tab. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. For example, if you close your business may 15, 20xx (the second quarter), file. Web employers use form 941 to: Web choose setup > clients, click the payroll taxes tab, in the forms section click the additional information button, and in the electronic filing section, click the final statement button. Web choose setup > clients and click the payroll taxes tab. Web up to 25% cash back file your final employer's federal tax return, irs form 941 or 944, and. Web employers use form 941 to: Pay the employer's portion of social security or. Web up to 25% cash back file your final employer's federal tax return, irs form 941 or 944, and your final federal unemployment tax return, irs form 940 or 940ez, by their regular due. Form 941 reports federal income. For example, if you close your business. Web form 941 for 2021: Under status, select deceased on the dropdown menu, then click. Form 941 reports federal income. Web pick the name of the employee on the list, then select the edit (pencil icon) beside employment. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important. Pay the employer's portion of social security or. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web you can probably simply file another 941 with the box checked and the requisite statement attached (print and mail) in addition to which you can include a. Pay the employer's portion of social security or. In the forms section, click the additional information button for the federal 94x form. Web information about form 941, employer's quarter federal tax refund, including recent updates, related forms, and instructions on like to file. Mail 941 is spent by employers. Web form 941 for 2021: Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web choose setup > clients and click the payroll taxes tab. Mail 941 is spent by employers. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Web employers use form 941 to: Click the final statement button. Web you can probably simply file another 941 with the box checked and the requisite statement attached (print and mail) in addition to which you can include a line. Pay the employer's portion of social security or. Then, put a check mark on part 3, line 17 and. For example, if you close your business may 15, 20xx (the second quarter), file. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web form 941 for 2021: Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web i can help you mark a 941 return as final. Form 941 reports federal income. Under status, select deceased on the dropdown menu, then click. Mail 941 is spent by employers. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. You will have to manually run and print the 941 form in quickbooks online. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web choose setup > clients and click the payroll taxes tab. In the forms section, click the additional information button for the federal 94x form. Web what is form 941? Web up to 25% cash back file your final employer's federal tax return, irs form 941 or 944, and your final federal unemployment tax return, irs form 940 or 940ez, by their regular due. Web pick the name of the employee on the list, then select the edit (pencil icon) beside employment. Web up to 25% cash back file your final employer's federal tax return, irs form 941 or 944, and your final federal unemployment tax return, irs form 940 or 940ez, by their regular due. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. You will have to manually run and print the 941 form in quickbooks online. Web you can probably simply file another 941 with the box checked and the requisite statement attached (print and mail) in addition to which you can include a line. Web choose setup > clients, click the payroll taxes tab, in the forms section click the additional information button, and in the electronic filing section, click the final statement button. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web information about form 941, employer's quarter federal tax refund, including recent updates, related forms, and instructions on like to file. Web employers use form 941 to: Mail 941 is spent by employers. In the forms section, click the additional information button for the federal 94x form. Form 941 reports federal income. Then, put a check mark on part 3, line 17 and. Under status, select deceased on the dropdown menu, then click. Web form 941 is due by the last day of the month following the end of each quarter. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.FINAL STATEMENT, FEB 14, 2013 by John PDF Archive

Irs Form W4V Printable Payroll Post LLC Forms your withholding

941 X Form Fill Out and Sign Printable PDF Template signNow

Form 941 Fill Out and Sign Printable PDF Template signNow

Printable 941 Form Printable Form 2022

Download 2013 Form 941 for Free Page 2 FormTemplate

Form Gr941 Employers Return Of Tax Withheld City Of

Calculating Qualified Wages For Employee Retention Credit TAX

20062022 Form IRS 941c Fill Online, Printable, Fillable, Blank pdfFiller

941 Form Fill Out and Sign Printable PDF Template signNow

Web Pick The Name Of The Employee On The List, Then Select The Edit (Pencil Icon) Beside Employment.

Web I Can Help You Mark A 941 Return As Final.

Web Choose Setup > Clients And Click The Payroll Taxes Tab.

Click The Final Statement Button.

Related Post: